Fleet Managers and Operation Managers are increasingly convincing their CFOs themselves that cash and fuel cards no longer work, as they experience on a daily basis the immense frustrations among themselves and drivers. The current economic situation and fuel crisis call for new solutions in a transport sector where mutual trust is traditionally low.

Three trends for transport companies

Drivers as well as their Finance and Operations departments experience a lot of frustration around expenses and claims. And those frustrations are increasing, as a result of three key trends for transport companies.

One is that drivers are increasingly having to fill up at other places because of the current fuel crisis. This also occurs at filling stations where the driver does not have a fuel card, while due to high inflation and economic recession, nobody wants to advance costs out of their own pocket anymore. Meanwhile, the huge staff shortage is forcing transport companies to make things easier for drivers with innovative solutions.

- Drivers sometimes need to refuel in other places The current fuel crisis is making it difficult for drivers to invariably fill up at their regular locations. In other cases, the crisis makes it difficult for drivers to fill up at least at the petrol station chain for which they have a payment card. In practice, it means that drivers must swerve on the road, for instance if fuel is not available at certain locations.The war in Ukraine, current economic developments and the high price of diesel and other fuels make it attractive to fill up across the border in more advantageous countries. In other cases, it is necessary, for instance, because certain petrol stations do not have sufficient supplies. If no payment card is available for the alternative filling station, drivers and the transport companies look for alternatives. A payment card from a particular filling station then no longer offers a solution.

- No one wants to advance out of pocket anymore The same economic situation and soaring prices, combined with massive inflation, are creating an additional challenge for drivers. Whereas in the past they were willing to advance unforeseen costs out of their own pockets, this is now much less common. Many drivers do not want to advance the cost, and others simply cannot advance it.They call the transport company they work for to make extra money available. Or they use an emergency envelope with cash money, which in turn the company has no control over. It leads to solutions that both drivers and the transport companies do not like, so for which they would like to find an alternative.

- Transport companies should make it easier for drivers Finally, there is a lot of pressure on transport companies. The current staff shortage in several markets in Europe is leading to great difficulty in finding new drivers. Companies must try harder to attract staff, and then cannot use frustrations over expenses and allowances. It increases the urgency to act now.

Much frustration for drivers as well as Fleet and Operations Managers

It is mostly Fleet Managers and Operations Managers at transport companies who experience this frustration. They are often called even in the evening hours and on weekends, by drivers who need extra money on the road. This is true, for example, when they need to divert to another filling station, just as when they suddenly have to spend the night elsewhere, when they need to have a repair done or when they incur other expenses.

And even at the time when a driver only has to incur the regular costs, it leads to a lot of administration, and frustration. Drivers must keep perfectly accurate records of expenses, and then submit a claim in Excel. Or they can use a fuel card, but then it is the Operations Manager who then has to check whether transactions are all correct.

Transport companies have traditionally been reluctant to issue credit cards to drivers. Many of the drivers only work for a relatively short time with the same employer, or even do seasonal work, and therefore do not build strong and loyal bonds. Mutual trust is too fragile to give a credit card in the company’s name, which would allow the driver to pay all expenses. The fuel card is an exception to this, but it does not allow for paying for repairs, overnight stays, and fuel at non-affiliated filling stations.

Solution for (large) transport companies

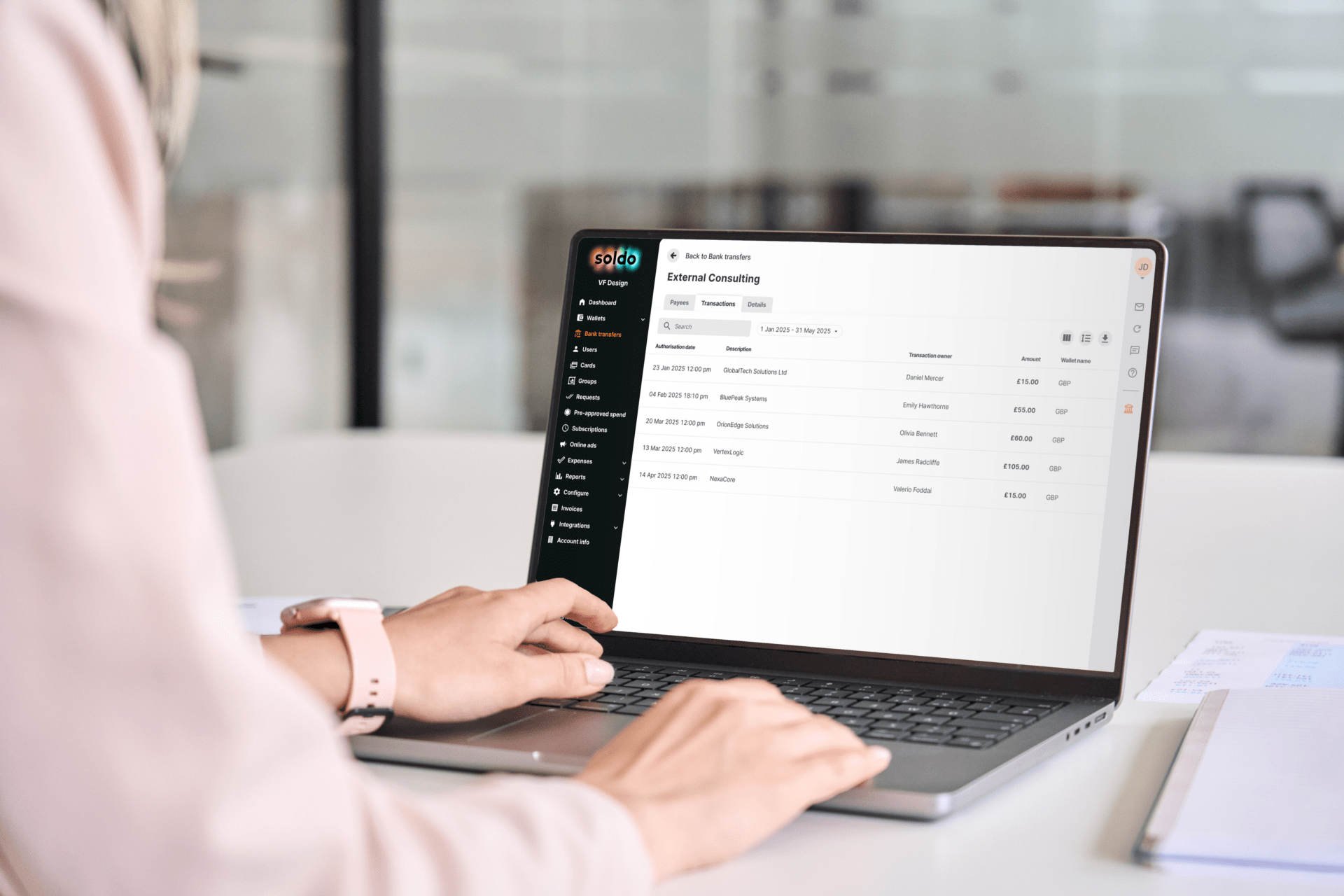

At Soldo, we offer a solution that works for both (large) transport companies and drivers. Our payment solution allows drivers to settle at the transport company’s expense. That applies to fuel, as well as overnight stays, lunches, repairs, and other expenses. That is, if authorised by the company.

Thanks to restrictions on specific spending categories, certain geographical areas and in other areas, it is possible to set exactly what a driver can spend. Then the transactions are immediately visible, from one clear dashboard.

Good practices at Titans and Sendsio

These advantages is the reason why many large transport companies we work for are happy to benefit from. A good example is Titans Group. They were not looking for a fuel card because it would make them dependent on a specific fuel supplier. On the other hand, they did suffer from high expenses and temporary workers in the peak season. With Soldo, they offer their drivers a simple payment solution, combined with a smart app. This gives Titans Group full control and all the necessary insight into transactions. Drivers, on the other hand, do not have to advance anything, even if they suddenly must swerve and fill up in an unusual place.

Sendsio also chose Soldo. This makes the monthly closing a lot less time-consuming, and day-to-day management is much less burdensome for Fleet Managers and Operations Managers. For them, a declaration now takes 30 minutes, whereas previously employees spent an average of half a day on it. There are no more advances and recoveries for fuel, overnight stays, and lunches. Moreover, the company has interfaced with their SAP software. As a result, even the organisation’s CEO and COO have real-time insight into costs and keep an overview more easily

Faster and with real-time insight and overview: Soldo

At Soldo, we offer a complete, user-friendly, and convenient payment solution. Transport companies use a payment card for drivers, which they can set up themselves. This prevents drivers from having to advance costs themselves or becoming dependent on specific suppliers for fuel, for example. It is no longer necessary to provide a credit card, while drivers can still pay anywhere with credit card is accepted.

Thanks to real-time visibility, overview, and possible links to, for example, SAP software and ERP systems, all data are always easily available. Links with the existing accounting software, for example, ensure that transactions are immediately entered correctly in the administration.

Would you like to know more about how Titans Group and Sendsio use our payment solutions? Or are you curious how your company can benefit from this? Together with my colleagues, I will be happy to explain it to you, even if, as a Fleet Manager or Operations Manager, you would like to do the talking yourself to convince your organisation’s CFO.

Check out Soldo.com or book a free, no-obligation demo to experience it for yourself straight away.

🎙️Podcast: Leveraging Real-Time Data with CFO of Transfix

CFO Christian Lee left WeWork in early 2021 for Transfix, a hypergrowth startup and leading freight marketplace connecting shippers to carriers. On this episode of The CFO Playbook, Christian talks about disrupting the supply chain industry in midst of economic crisis, describes why automation is in his top three priorities for this year, and underlines why Transfix places real-time data at the center of every decision they make.

CFO Christian Lee left WeWork in early 2021 for Transfix, a hypergrowth startup and leading freight marketplace connecting shippers to carriers. On this episode of The CFO Playbook, Christian talks about disrupting the supply chain industry in midst of economic crisis, describes why automation is in his top three priorities for this year, and underlines why Transfix places real-time data at the center of every decision they make.