Consider these when choosing a fuel card for your business

There’s a lot to think about when choosing a fuel card for your business. Whether you run a large fleet, or you have several field operatives out on the road, saving money on fuel costs is an important consideration. There are so many to choose from, so how do you decide on the best fuel card to meet your company’s needs?

To help you decide, we’ve prepared a list of key points to consider:

Administrative load

Every accounts office knows the frustration of dealing with endless scrappy receipts, but a fuel card can make light work of business expense reporting, at least for this type of expense. Fuel cards deliver monthly or weekly invoices, which are all created in a format approved by HMRC — making it much easier when it’s time to fill out your return and claim back VAT.

It’s important to ensure that fuel cards are monitored regularly by admin teams as fuel card fraud is on the rise.

Fuel type

You’ll need to establish whether your company vehicles rely on unleaded petrol or diesel, before selecting your business fuel card. Some cards are exclusively for petrol or diesel, while other cards allow you to refuel with either type.

Type of fleet

The type of vehicles used in your business will determine your overall choice of card. If you only have a few cars out and about, your needs will be very different from a company with a large fleet of HGVs, for example. But remember to factor in the growth of your business. It may be appropriate to select a card with extra benefits that you don’t need now, but are likely to need in the near future.

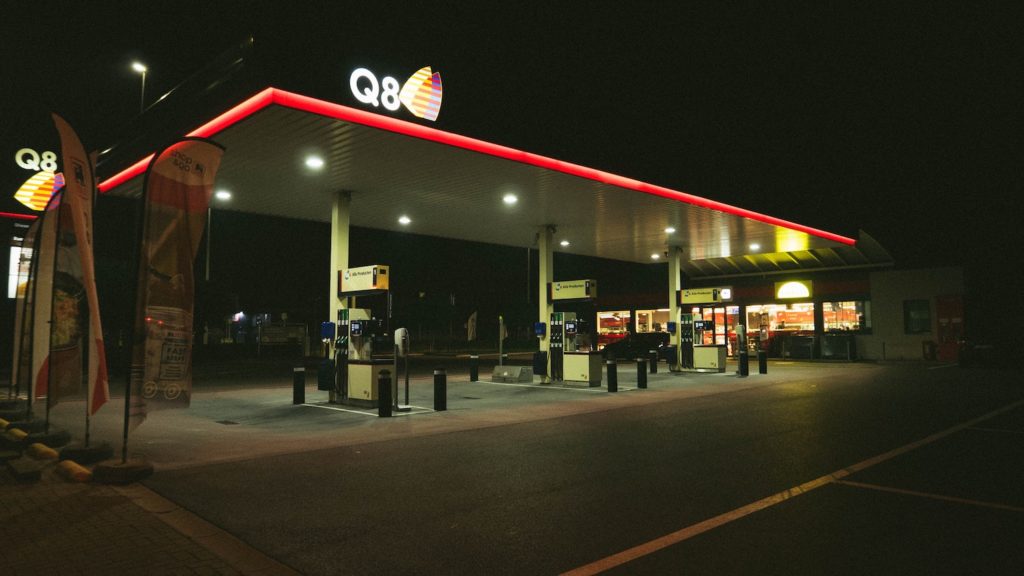

Coverage

It is worth considering where your company vehicles are operating. If employees work locally, then a card that’s compatible with your local fuel stations will be the most appropriate choice. But if your business has cars, vans or lorries travelling further afield, then you’ll need to think about the service stations that will be most convenient for your employees to use.

Pump vs fixed price

Some fuel cards require you to fill up as per the price displayed on the pumps and forecourt. However, many fuel cards offer discounts on fuel, offering generous savings for firms using a great deal of fuel.

Non-branded or branded

Branded cards are affiliated with a particular fuel brand, which may be the best option if you operate throughout the length and breadth of the UK. Whereas non-branded cards, which allow you to fill up at supermarket fuel stations, for example, might be the better option, especially if your business operates locally.

Be sure to check which pumps are accessible to your fuel card across the network. Savings on fuel can quickly become redundant if your employees have to drive out of their way to fill up at a qualifying service station.

How much do fuel cards cost?

The cost of fuel cards is something that requires careful consideration before you reach a decision. Discounted fuel may represent savings, but there are associated costs with the majority of fuel cards, so you need to be very clear as to what they are.

For example, a fuel card may carry a condition for a minimum monthly spend. Most fuel cards require a minimum spend of £200 per month, so this needs to be factored in. There is also usually an initial administration charge for setting up your fuel card account, as well as annual fees for every card issued. Depending on your choice of fuel card, you may also be required to pay yearly or monthly administration fees.

A more in depth discussion on the cost of fuel cards can be found in our Complete Guide to Fuel Cards.

Does the fuel card need limits?

Although a fuel card operates in a very similar way to a credit card, the key difference is that the majority of fuel cards can only be used for filling up at the pumps. However, some cards allow you to make other purchases, such as hot drinks, magazines and snacks, so you’ll need to consider whether this is something that you’d like your employees to be able to do.

Fuel cards link to either a specific vehicle or driver or sometimes a combination of both. It’s often possible to place specific restrictions on cards, such as only authorising it for diesel or unleaded petrol.

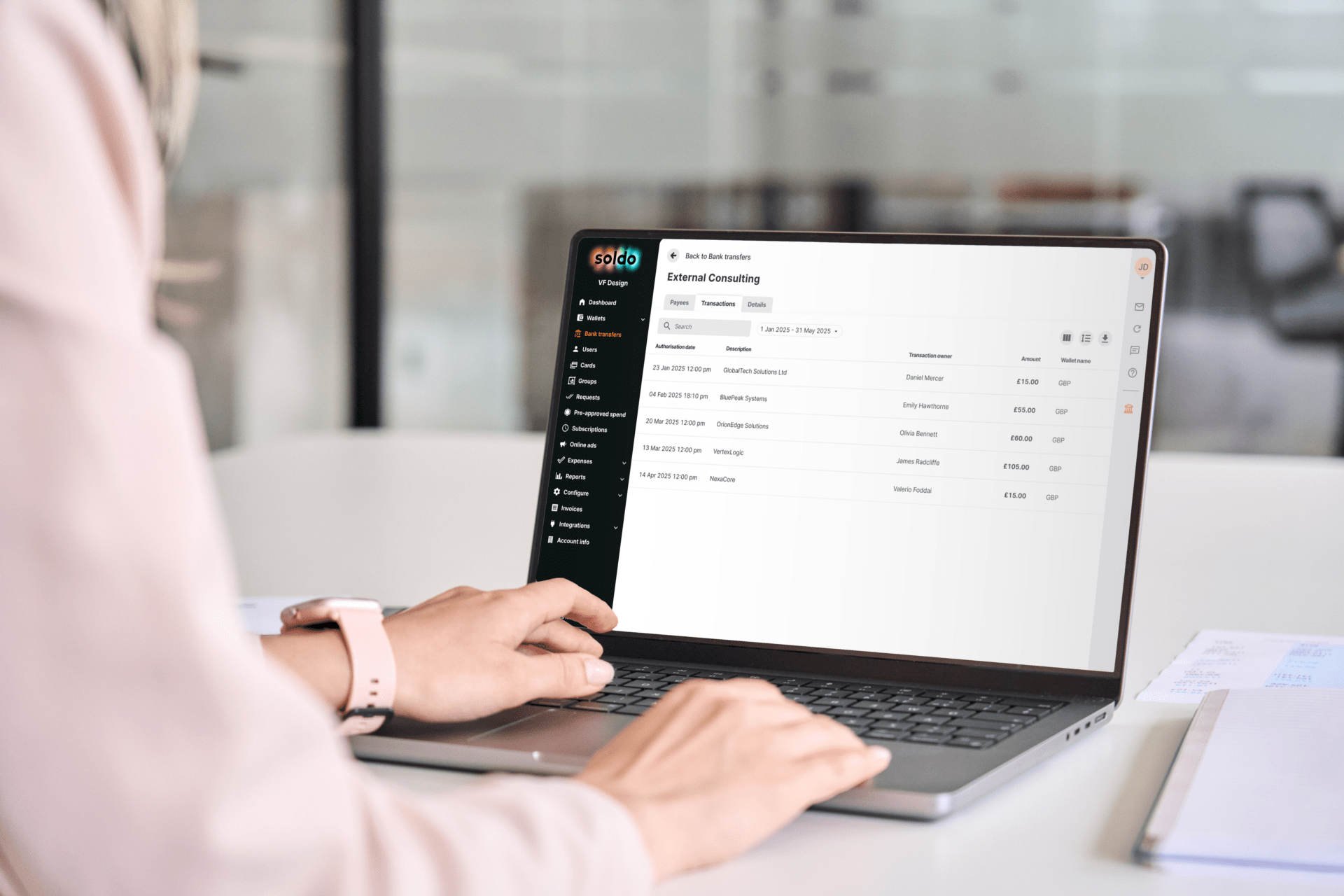

There is a wide range of fuel cards, all offering their own benefits to employees and businesses. However, sometimes, a more all-in-one option such as the purchase of a prepaid debit card might be more suitable to meet company needs.

With Soldo prepaid cards, managers can load it with the required fuel money for staff, while still being able to keep tight control over company-wide spending. Soldo offers fully customisable physical and virtual prepaid business cards for your whole team that you can tailor to your exact needs, offering the same time saving and administrative benefits as a fuel card, however, over a far broader range of business expense types.

The best fuel card is a fuel card that offers more

Looking at the above list of popular cards, there are plenty of options when it comes to choosing a fuel card for your business.

However, you may wish to simplify things further by using a prepaid business card. You can use it to load fuel money for your staff, so they never have to worry about paying for their fuel using their personal finances when they’re out and about on business.

Soldo offers one of the best prepaid cards for business, with fully customisable rules so that you can control your employee spending seamlessly and minimise the associated reporting and administrative overhead. Soldo provides similar benefits to those of fuel cards but across a far broader spectrum of expense types.