What is a prepaid card?

Prepaid cards offer a modern take on managing employee expenses. They work in the same way as a regular debit card for making purchases or payment transactions, but additional limits are in place to control how and where funds can be spent.

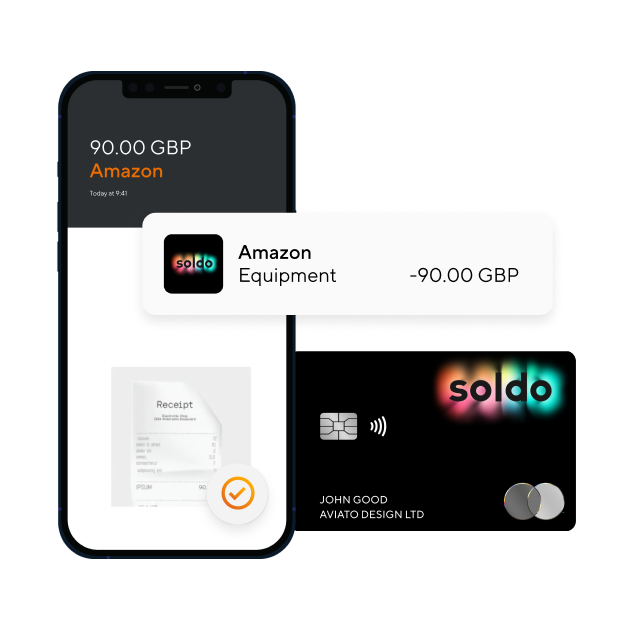

They offer employees quick and convenient access to money and are easy to manage from a central company wallet. Prepaid cards can be topped up as and when necessary, with real-time reporting on transactions to give a clear, concise overview of how money is being spent.

How does a prepaid card work?

With Soldo prepaid cards, you have complete control over your financial activity. You can issue cards to employees across multiple departments, set budgets to limit spending, and monitor where funds are being used. The transparency and simplicity of using a prepaid card allow you to eliminate time-consuming admin and focus on other aspects of your operations.

When would you use a prepaid card?

A prepaid card gives your teams the flexibility to make purchases and payments whenever and wherever they need to. Soldo prepaid cards can be used for in-store purchases, contactless transactions or online payments, in the same way you would usejust like a traditional debit or credit cards.

How does a prepaid card differ from a credit card?

Prepaid cards offer organisationsin the UK a safer and more controlled approach to spending. Employees can only spend funds that have been deposited onto the prepaid card, which eliminates the risk of overspending or accumulating debt that can be common when using a credit card.

How can I add money to a prepaid card for my team?

Adding money to your Soldo prepaid cards is straightforward. You can choose one of the following options:

- Bank transfer: Add money to your company wallet in to 24-48 hours for GBP and EUR. USD can take up to five working days

- BACS: Faster payment option, with funds typically available for use immediately

- PayPal: Instant transfers in up to 30 minutes, or up to 3-5 working days for standard transfers

Can I check the balance of my prepaid cards?

Checking the balance of your prepaid cards is quick and easy. You can access your real-time balance via our mobile app or online, or receive a notification via text. You can also use an ATM to see what money you have available.

Can I issue multiple prepaid cards to my employees?

No matter the size of your organisation, our prepaid cardshave got you covered. You can issue a prepaid cardto multiple employees within your team, or colleagues you work with externally, to have complete control over their spending limits.

Can UK prepaid cards be used for international transactions?

Yes, they certainly can. With Soldo, you can make international payments in several currencies including GBP, EUR and USD using your prepaid card. This means that if your employees are required to make a business trip abroad, they’ll still have quick and convenient access to the funds they need.

Please note, there’s a small foreign exchange fee for using your card to pay in a different currency.

Can I withdraw cash from a prepaid card?

In the same way you would with a business debit card, you can withdraw money from a Soldo prepaid card using an ATM. Our prepaid cards have withdrawal limits that may vary depending on your account. You can find out more by logging into your account.

How much does a Soldo prepaid card cost?

The size of your organisation or the number of prepaid cards you require will determine which Soldo plan is right for you. We have three options to choose from, each with their own key features.

With the Standard plan, you get access to all our core features such as the use of the mobile app, reporting and integration, and access to our online support centre. The Plus plan offers a more comprehensive solution, including multi-currency support and advanced receipt capture and reporting.

If you are interested in finding out how Soldo can transform your organisation’s spend management solutions, you can try either plan free for 30 days.

For larger organisations, our Enterprise plan comes with unlimited users, cards and wallets, so you can ensure each employee has access to the funds they need at any given time. You’ll also benefit from additional personal account management and professional services.

You can find out more about our pricing online or request a call back for further information.