Petty cash is a system that’s riddled with vulnerabilities. Switch to Soldo’s smart prepaid system and watch it revolutionise your finances. Get your first 3 cards free.

The problem with petty cash

If you’ve landed on this page, chances are you’re using a petty cash fund for your business expenses and you’re looking for something different. This is understandable, as petty cash is an increasingly outdated method that businesses are moving away from.

Our petty cash hub can direct you to all sorts of information around petty cash, from books to boxes, but in this article we’re going beyond petty cash to think about alternatives. There are numerous systems to choose from, but only one will be the best fit for your business.

Why it’s time to move on

As you have probably realised, petty cash is an expense management system that’s riddled with vulnerabilities. For starters, having a shared pot of cash that employees can dip into is always going to pose a security risk. If there’s an instance of theft then you may not even realise until weeks later when your petty cashier carries out their reconciliation.

And the problem needn’t be as dramatic as theft; petty cash’s reliance on physical receipts means that there’s plenty of opportunities for important paperwork to go missing. With lots of people accessing the same petty cash fund, things can easily spiral out of control.

As well as security, petty cash also poses a visibility problem. We’ve seen that receipts can easily be lost, but you can also be left in the dark as to who paid for an expense, or why it was necessary. Depending on the level of detail in your petty cash book, reading through that may not provide an answer either.

Petty cash is particularly unviable in a post-Covid world in which cash’s unpopularity is only accelerating. You don’t want your team to have to rely on cash when an increasing number of businesses are going cashless.

Soldo’s prepaid cards and the Soldo expenses app are great solutions to avoid these problems, allowing you to retain complete control whilst empowering employees to spend responsibly.

Alternatives to petty cash

One alternative to a petty cash fund that’s still used by some businesses is to have employees front their own costs and devote time each month to reclaiming the money they’re owed.

However, this is hardly more effective. You won’t expect your team to pay for big ticket items like flights or travel expenses, but often it’s the small expenses that can prove even more problematic: a few drinks with a client or a meal out whilst travelling.

These charges can add up, and lost receipts or inefficient reporting often leads to short-changed employees. This isn’t great for morale, and can cause difficulties for those who don’t have the money to spare.

Business credit card

Thankfully, there are options out there that are designed with more efficiency in mind. One of the most popular of these is the business credit card. Business credit cards function much in the same way as a personal credit card, allowing employees to pay for their expenses quickly and easily without resorting to using their own money.

Company credit card

This option is certainly more secure than physical cash, but it has its own set of problems, and even shares some issues with petty cash. With a company credit card you can rarely set a limit, meaning spending can easily spiral.

Keeping records of business expenses

Exacerbating this problem is the time it takes to receive reports. You may not even realise you have an overspending problem until a statement comes through, and that can often take a while.

A petty cash fund and credit cards both rely on a variety of physical processes to work efficiently. There must be a well-maintained collection of receipts, a logical way of keeping track of the shared payment method itself, and a detailed log of transactions.

With cash you may even have two logs: the petty cash book as well as a separate ledger for a wider array of company spending. With each link in the chain, the vulnerability of your finances increases.

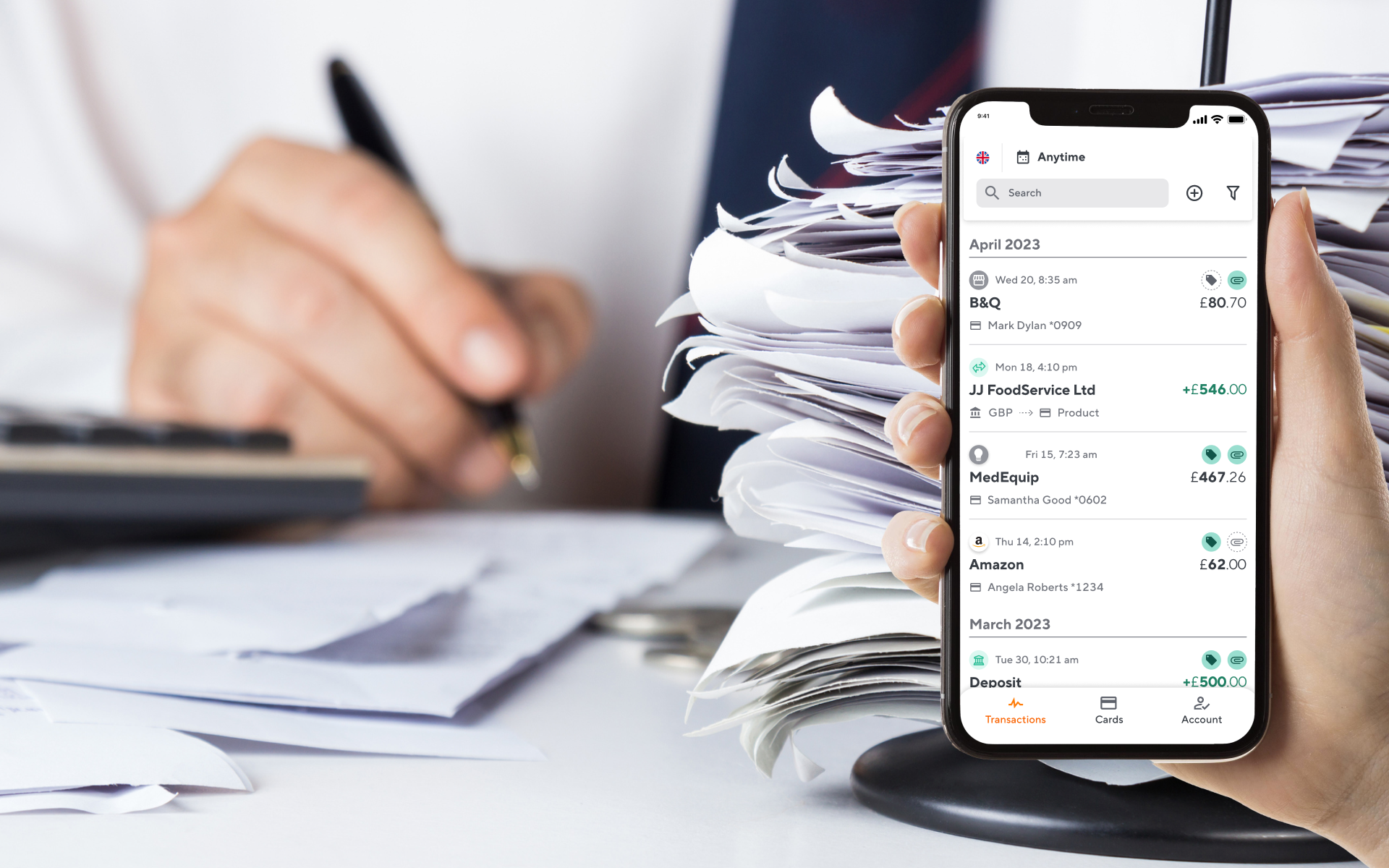

With Soldo’s prepaid card and expense management software everything happens in one place. Cards can be virtual, so employees can make a contactless payment on their phone and upload a photo of the receipt to Soldo, where it is immediately logged with other transactions. No links in the chain, no one to chase up, just complete visibility.

How Soldo’s prepaid solution can boost your business

We’ve already mentioned how Soldo provides answers to many of petty cash and its alternatives’ problems, but let’s go into depth on Soldo’s complete spending solution using prepaid cards and great expense management software. From the point of purchase to the bookkeeping, Soldo saves you time and money.

You can order as many Soldo Mastercard®️ cards as you like, and distribute them however you deem fit. It could be one card per person, team, department, or even vehicle. You then load the card with a balance and establish spending rules. Is this card just for a particular type of expense? Then you can set it that way.

Employees can use this card as they’d use any payment card. They pay at the till or online, then snap a photo of the receipt, add any necessary comments, and that’s it. You as an admin can then view every transaction, from every card, as it happens. You can do this through the Soldo mobile app or desktop console.

And it’s not just monitoring you can do either. If your team ever needs a top-up while they’re out and about, you can transfer them funds remotely, so employees who are out of office are never out of pocket.

Once you’re ready to reconcile your expenses, our seamless integrations with accounting software such as QuickBooks, Xero, and NetSuite mean you can transfer all your spend data in no time at all. That’s bookkeeping as it should be.

And those are just the basics of Soldo. There’s much more to discover, but as you can see, Soldo’s base features are designed with businesses in mind, and everything we offer makes life easier for you and your team.

Say goodbye to your petty cash fund and save your company time and money by switching to Soldo today.