How to manage business expenses

For the majority of small and medium-sized companies, managing business expenses is a priority, and something they must get right if they are to succeed. It is also something that takes time and requires almost constant monitoring, which might make it seem daunting. However, expense management doesn’t need to be onerous if you and your senior management team take some simple steps to ensure business expenses are kept under control.

Understand your current financial situation

Before you can successfully manage your business expenses, you need to make sure you understand where you currently stand financially. This will help you to identify any changes to budgets, expenditure, or processes you might need to make. Take time, working with your finance team if you have one, to review your finances.

Don’t assume that the budget you set at the start of the financial year or assumptions you made in your business plan still stand unless they are being regularly reviewed. Look at your levels of income and expenditure, whether you are making a profit or loss, and where costs are highest. If you are making a loss, look at discretionary expenses and make cuts if needed.

Set your budgets and review them regularly

Once you understand your current financial situation, use this to confirm that budgets are accurate and reflect the environment in which you are working. Make sure the budgets cover all essential costs such as payroll, rent, utilities, and staff expenses as well as incidentals. Then, develop reports that can assist you in monitoring expenses and keep an eye on your cash flow. It is best to review these reports on a weekly basis, which will allow you to identify trends and respond quickly to any potential issues.

Reconsider your overheads

In starting out in business, many of us think that a nice office in a prominent location is what we need. And it might be. However, it may be just as easy for you to work from home or share office space. Consider these options before you sign an expensive lease with a long term commitment that you don’t need, increasing your overhead costs for some time to come.

There are any number of options out there for shared, low-cost office space, which also help to control ancillary costs including utilities. If you are worried about where you will meet clients, you can rent meeting rooms when you need them.

Keep an eye on staff expenses

Staff expenses are one of the areas that can get out of control before you know it, especially if you use business credit cards or petty cash to cover costs, not to mention if staff need to cover costs out of their own pocket, only to have to wait to be reimbursed at the end of the month. Because these are often only reported at the end of a month, there is a significant risk of overspend, putting your bottom line at risk.

Staff expenses can also be hard to track as people miss deadlines for submitting claims or lose the receipts that evidence they spent money in line with company policies.

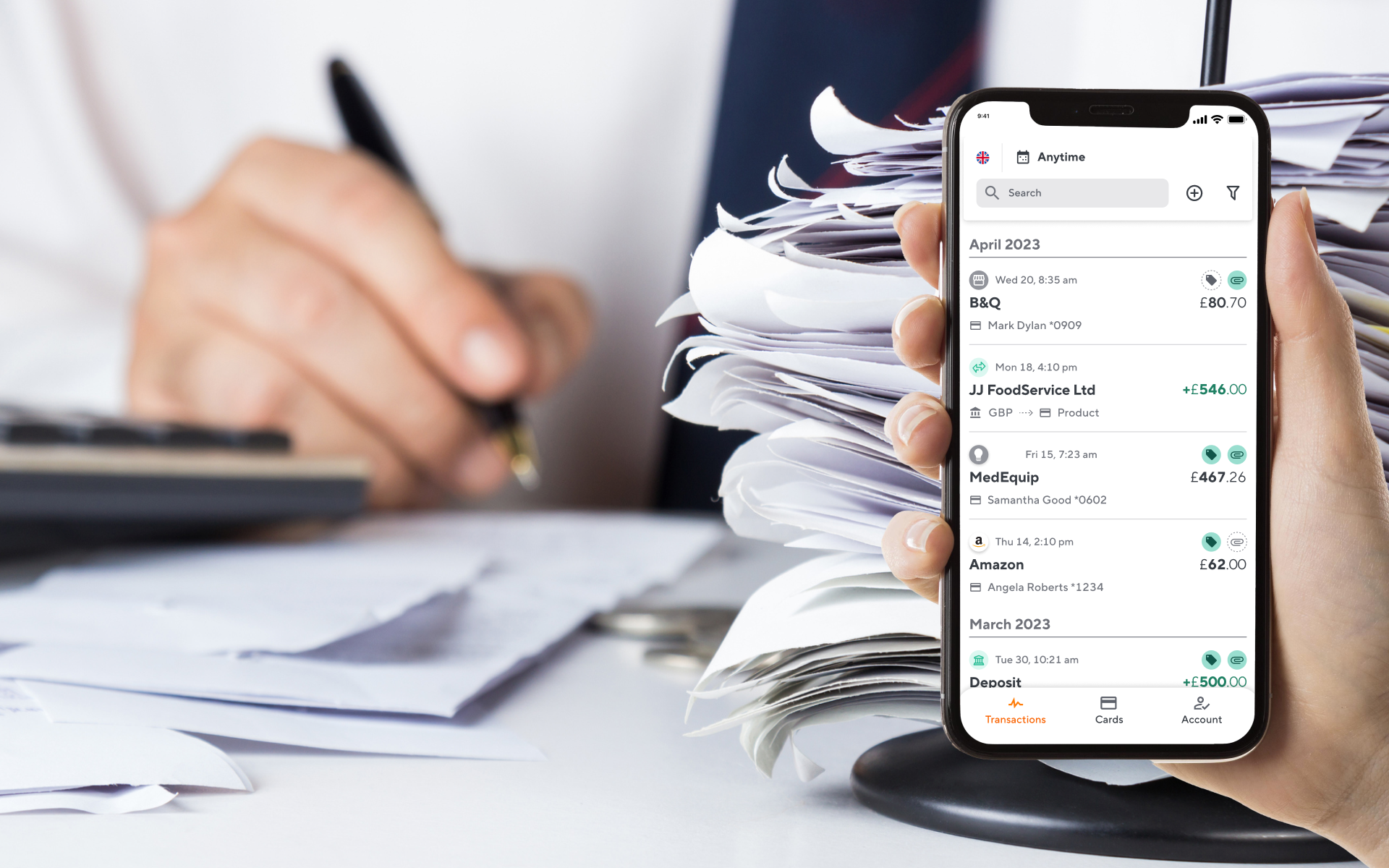

While you can’t get away from spending money on employee expenses, you can manage it closely by using prepaid business cards such as those offered by Soldo, which removes the need for petty cash in offices and company credit cards. The cards allow you to add as little or as much money as you want; set limits and rules for spending for each individual; and obtain real-time reports on what people are spending, when and where.

Soldo’s prepaid company cards also come with the added benefit of being part of a more extensive financial management tool, helping finance teams and small business owners streamline the expenses process. With limits already set on cards and the ability to track spending through the tool’s easy to use and understand web console, there should be no surprises at month end.

This means less time spent by you or your finance team chasing down or querying expense claims and more time for making sure you are operating as cost-efficiently and effectively as possible.

If you would like to find out more about what benefits a prepaid business card can bring to your business, contact us for further information and advice.