The UK’s best company bank accounts: a guide for small businesses

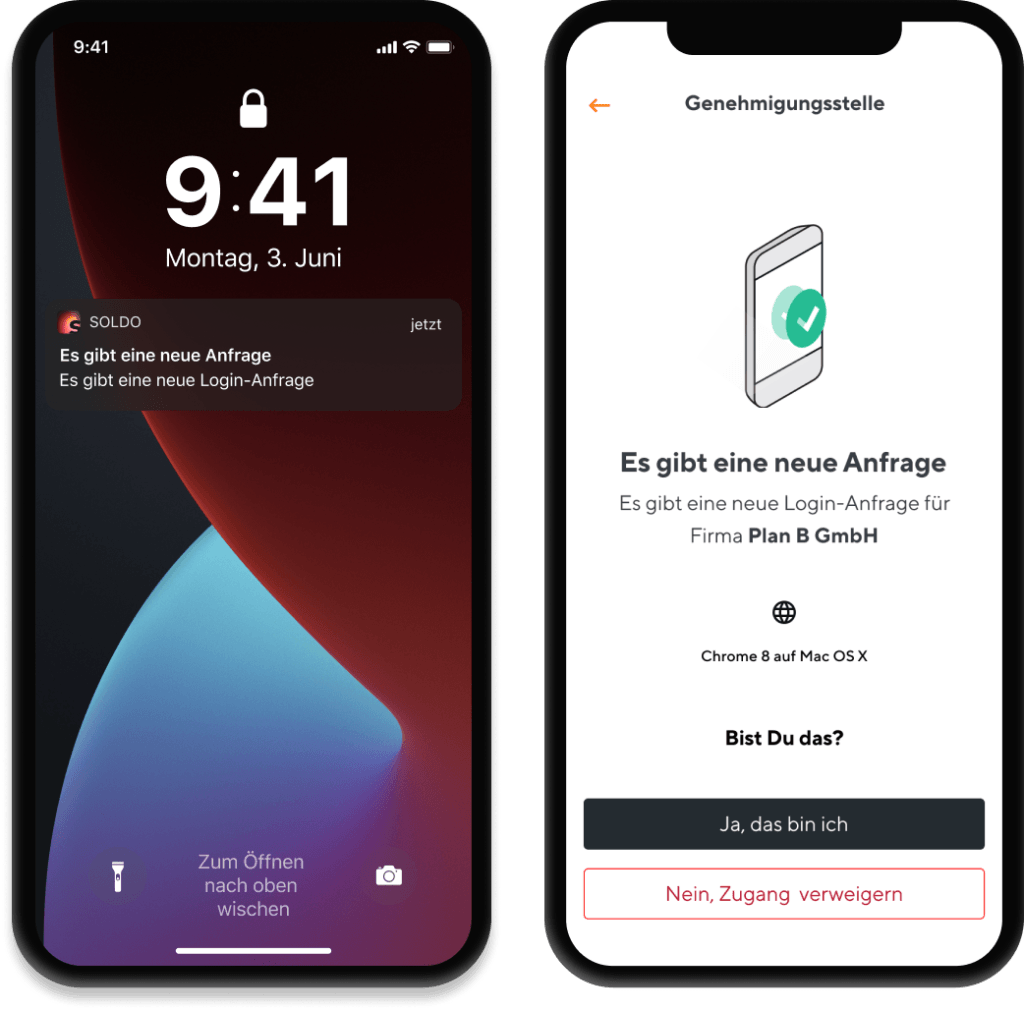

Control spend with company cards that do your expenses for you. Soldo connects smart company cards to intuitive management tools. Control, track, and report spending – all in one place.

See transactions as they happen, set budgets from your phone or desktop and simplify monthly expenses admin.

Opening a company bank account is a big decision. Making the right choice could make a significant difference to your day-to-day operations, and you’ll benefit from all the banking support that a good account provider offers. The difficulty is in finding the best account for your business.

While Soldo is not a company bank account, it could make a real difference to the way you handle expenses. By issuing prepaid Mastercard® cards to employees, you could provide your workforce with everything they need to pay for company essentials without letting them loose with a company credit card.

Even still, the chances are that you’ll need to open a company bank account to handle everyday income and outgoings. With that in mind, we’ve prepared the following guide to help you choose the right company bank account for your needs.

What is a Company Bank Account?

A company bank account is not all that different from the current accounts you’ve probably opened for personal use. The key distinction is that they are focused on company use, and can offer a range of specific services to help you manage a company. These can include budgeting tools, account management systems, and integration with accounting software.

It’s also worth noting that company bank accounts often come with a cost attached. While banks commonly allow their customers to open personal current accounts for free, this is less typical for business clients.

Do I Need a Company Bank Account?

Whether you need a company bank account very much depends on the status of your company. Sole traders, freelancers, and contractors are not required by law to open a company account – although it is generally thought of as a good move.

In the UK, limited companies are legally obliged to open a separate company bank account. This is because they technically operate as separate legal entities and so shouldn’t be using the same bank account as their directors.

How to Choose a Company Bank Account

Before you can opt for one banking provider or another, you’ll need to know what to look for in a company account.

Ultimately, this comes down to the individual needs of your company – for instance, how much you can afford to pay regularly, in addition to the particular features you need.

Account Features

While all company bank accounts offer broadly the same basic service, many of them come with their own unique set of features. These can include anything from commercial advice to free transactions and even web hosting.

The important thing is not to get drawn in by attractive but unnecessary features, and instead to focus on the fundamentals. Opt for an account that offers what your business needs, and don’t be tempted to pay a premium for services that you could access for less elsewhere.

Interest Rates and Transaction Fees

Interest rates and costs should be a key consideration for anyone seeking to open a new business bank account. The amount of interest paid out on business funds could make a substantial difference to your bottom line, while transaction fees could make all the difference between a net profit and a loss.

It’s essential to consider how a business bank account will function in line with your company’s operations. If you have high transaction volumes, you’ll want to choose an account that doesn’t impose extra tariffs based on the number of payments in and out. Similarly, it’s worth considering whether your company’s funds are being put to good use – and a high-interest rate could improve your overall financial prospects.

Branch Banking and Online Access

These days, online banking has become the norm – both for personal and business accounts. When your firm’s money is on the line, waiting on hold for a customer services adviser simply won’t cut it, so it could be a smart move to choose a bank that offers access to local branches and business finance experts.

When you are using an online banking facility for the day-to-day running of your accounts, you’ll be better served by a user-friendly service with helpful features. For this reason, it pays to consider how each bank’s online platforms work – and to choose the one that you’ll find easiest to deal with.

Can Foreign Companies Open a UK Bank Account?

Many companies that are registered overseas express an interest in opening a UK bank account. The benefits are clear since doing so can make it easier to conduct business in Great Britain – which is widely regarded as one of the world’s great financial centres.

Several foreign banks have established ties with British financial institutions, so it may be possible to ask your existing banking provider to help you open an account in the UK. Many domestic banks also offer international accounts, and while these often come with significant cost commitments, they can usually be set up without the need to operate from a UK address.

For international businesses that need to pay for employee expenses in the UK, Soldo may be a better option. Working with companies from around the world, our prepaid cards empower individual employees to pay for their expenses while traveling – all without the need to open separate commercial bank accounts.

What is the Best Bank Account for UK Companies?

In truth, there isn’t one business bank account that stands out of the crowd. The best choice for your company will be the one that meets your individual needs, and there are plenty of options on offer.

Some of the most popular UK business bank accounts include:

Barclays

Barclays offers a free business banking facility for up to 12 months, with account holders then being offered two separate pricing plans. The online application process is quick and easy, and successful applicants also benefit from access to a secure cloud storage service.

HSBC

HSBC provides a wide range of business banking services, with a company banking specialist available on-demand at every physical branch. They offer a complete complement of telephone, mobile, and online business banking facilities, and also issue guidance on how to improve cash flow and start trading overseas.

Lloyds Bank

Lloyds Bank offers an extensive range of business banking facilities, including a free banking period of 18 months for new start-ups. They are known to have helped thousands of new businesses navigate legal, regulatory, and tax requirements in the UK and beyond.

NatWest

NatWest’s business banking services come with a range of benefits, including access to online and telephone banking, alongside free advice to help establish and grow new companies. Their business current account is available for free for an initial period of two years.

Santander

With Santander, start-up businesses benefit from between 12 to 18 months of free banking services. During that period, companies enjoy free and unlimited everyday transactions – making it easy to improve your cash flow without incurring extra costs.

Metro Bank

Metro Bank’s business current account boasts a user-friendly online interface and is designed to provide a robust day-to-day banking solution for firms with an annual turnover of less than £2 million. Accounts come with a simple switching service and free European transactions.

The Smart Way to Pay Company Costs

While there’s no escaping the fact that business accounts are an important part of trading in the UK today, they aren’t the only option available. You may have noticed that the major banks outlined in the guide all offer strikingly similar services with little to differentiate one from another.

For companies that want a more intuitive approach to expenses, Soldo prepaid Mastercard® cards may be the solution. They’re an effective tool that can empower employees to spend as needed without giving them access to the company bank account.

Beyond this, Soldo’s easy-to-use admin console and employee app make reporting easy, all while integrating with your existing accounting software. You’ll get an up-to-the-second overview of who’s spent what, while all the data will drop seamlessly into your Xero or Quickbooks records.

Choose the Complete Business Spending Solution

Business bank accounts can be costly to run and difficult to manage. To take control of your business spending, sign up for Soldo in five minutes and start automating the expenses process.