The open banking ecosystem is changing how SMEs bank

Small businesses no longer need to rely on one-size-fits-all products or paper statements. Technology now does the heavy lifting. There are now options to connect to and create the right financial environment for specific requirements.

The rise of challenger banks is, therefore, disrupting business banking. By offering customer-focused strategies, they deliver precisely the type of tailor-made banking that SMEs need. And traditional banks are struggling to keep up.

The number of banking app users is predicted to hit 2.3bn in 2020, while in-branch visits continue to decline as bricks and mortar banks close their doors. When it comes to setting up your business bank account, could challenger banks be the right solution?

What is a challenger bank?

Challenger banks are big financial news, pulling in millions in investment capital in 2019 alone. The UK sits at the leading edge of the challenger bank movement, with the new entrants challenging the Big Nine high street banks by focusing on what customers want and meeting their needs with innovative tech-based solutions.

The rise of challenger banks follows on from the deregulation of open banking and the increase in forward-facing fintech startups delivering new services in the online space. These are banks that are throwing away the rulebook to make banking as customer-friendly as ordering your shopping.

High street vs challenger banks

Traditional banks have a reputation for being slow to change and bureaucratic. There’s little differentiation between the services they offer and the 2008 banking crisis led to a significant loss of customer trust. However, the high street banks can depend on national and international banking networks, a solid technical infrastructure and longstanding expertise, making them an attractive proposition for a new business.

The challenger banks aim to disrupt the market by offering new concepts in banking. They are changing how banking and payments work, offering new and innovative solutions. Their focus on customer-driven solutions and flexibility makes them lean and keeps them competitive, able to provide products and services directly driven by the needs of SMEs.

What can challenger banks offer your SME?

Seamless customer experience

From fast and paperless onboarding to bespoke products and services, challenger banks deliver an account that fits your business. A fintech startup will offer everything your high street bank does, and more.

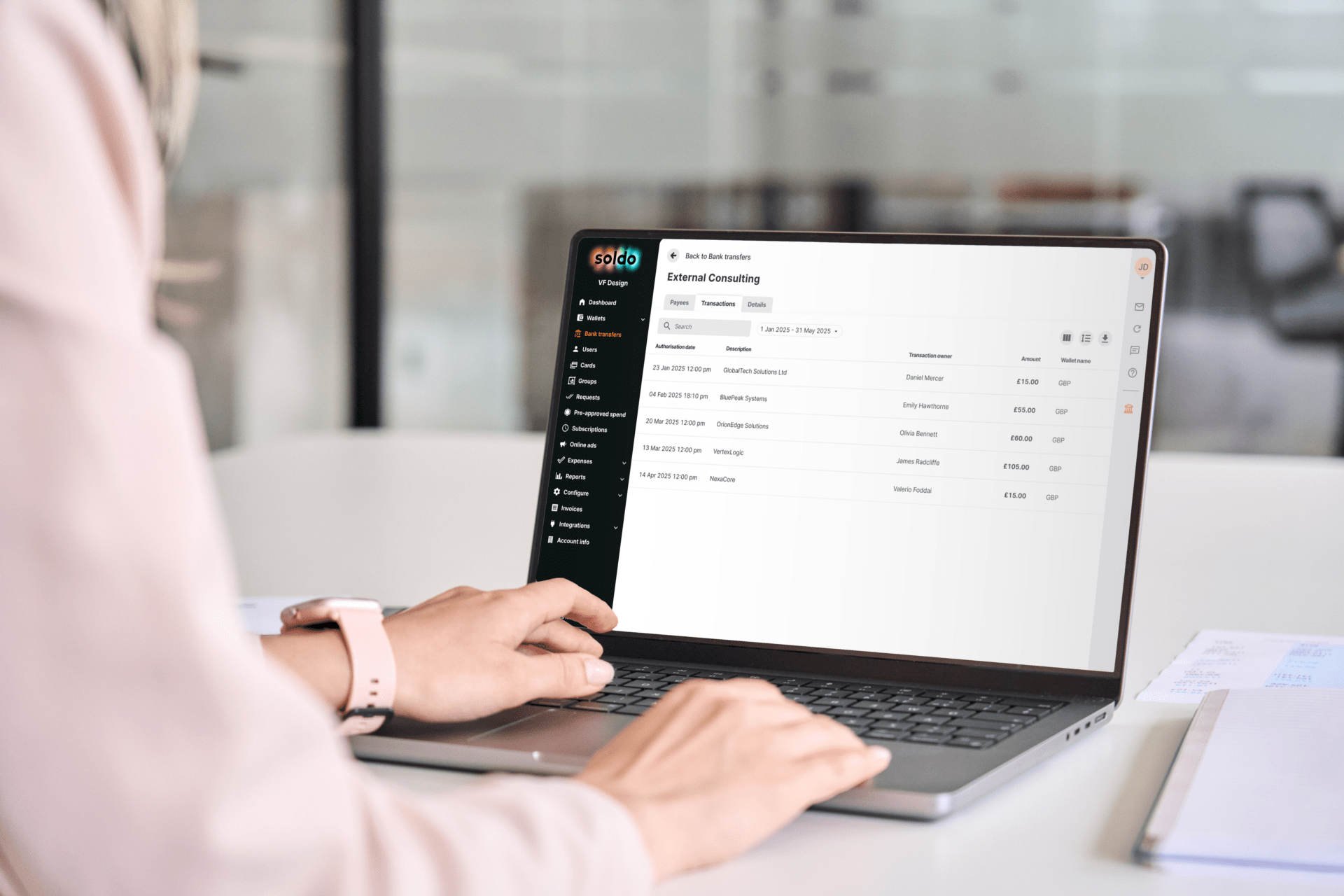

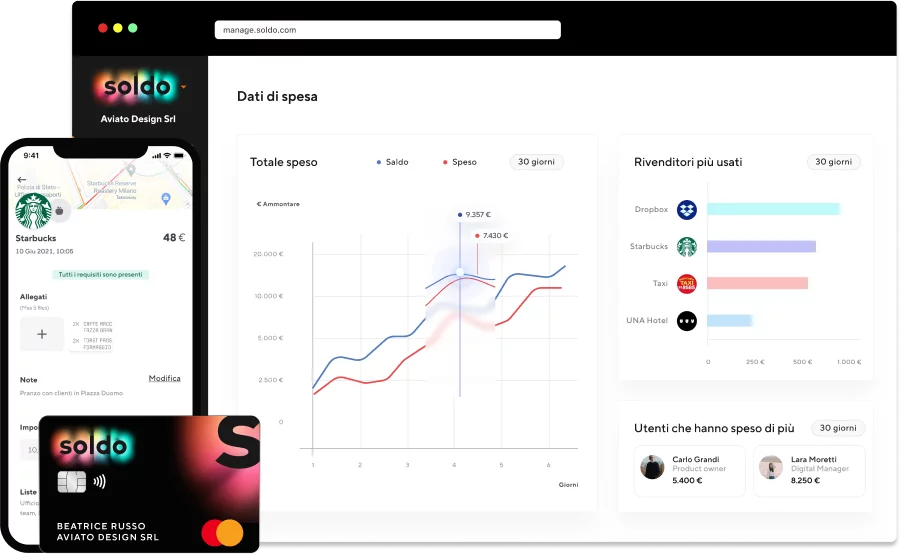

Challenger banks occupy the online space, with features including data sharing with accountants, invoice creation, multi-account dashboards and actionable insights are valuable for small businesses.

All of this can be accessible in just 10 minutes with fast account setup.

Technology and innovation

Challenger banks are ideally placed to benefit from the explosion in fintech in the UK, which now accounts for 11% of the worldwide market. That puts UK SMEs at the leading edge when it comes to benefiting from new banking developments. With higher levels of internal employee engagement and loyalty, challenger banks can continue to innovate and disrupt, especially with a workforce that shares their goals and vision.

In comparison, a traditional bank can seem somewhat stale and stagnant. Its tech offerings may not be user-friendly or responsive to user needs.

Do more with your data

Fintech startups are using APIs in ways that your traditional bank may never have considered. The proliferation of banking apps through the open banking ecosystem enables you to gain access to different data sets with greater security than ever before. This granular control of data can be managed remotely and allows your business to gain more precise insights and identify any anomalies in seconds.

Making the right choice for your business

As transformational as challenger banks can be for business banking, there are some distinct disadvantages. The challenger banks are, by definition, smaller than the incumbent big nine banks. The Financial Services Compensation Scheme currently covers small businesses up to £85,000 if a bank fails, but this may not offer enough reassurance if the worst happens.

Despite the clear advantages of the challenger banks, the tried and tested approach still holds sway for some SMEs. If your relationship with your existing bank includes excellent service and competitive rates, there may be no impetus for change.

When it comes to attracting new business accounts, both traditional and challenger banks have benefits and disadvantages that merit careful consideration. Traditional institutions that are too inflexible to change themselves will leverage the fintech ecosystem and create partnerships to remain relevant to small businesses as startups continue to disrupt the system.

Ultimately, choosing the right business bank for your SME will depend on your business banking needs. The good news is that there is now a far greater choice in identifying a suitable financial institution.