As a Chief Marketing Officer (CMO), I’m no stranger to pressure. We’re expected to do it all: manage budgets with precision, invest wisely, and deliver measurable returns on investment, all while navigating increasingly strict legal and procurement processes.

Marketing is no longer just about creativity and campaign success – every decision is scrutinised for its financial impact. We need to be able to pivot quickly, seize opportunities, and ensure that every dollar or euro spent contributes to the bottom line. And while marketing tools have helped us be more agile, traditional financial systems often work against us, bogging us down in complex layers of approvals that sap energy and slow us down.

That’s why I am so excited about Progressive Finance. It’s an approach designed to break down those barriers, empowering marketers and other functional teams across the business to move faster, invest more strategically, and still maintain full control and accountability by finance teams. With Progressive Finance, we can decentralise spend management, trust our teams to make smart decisions and use technology to simplify complex processes.

It’s not just about reducing admin or increasing efficiency – it’s about making sure we’re equipped to respond to business needs in real time and maximise the return on every investment we make.

The five principles of Progressive Finance

1. Trust and autonomy

One of the biggest challenges marketing leaders face is balancing agility and creativity with fiscal responsibility. Marketing teams are often seen as spending centres, so we’re under constant scrutiny to justify every expense. Progressive Finance allows us to give teams more autonomy over their budgets, building a foundation of trust. This doesn’t mean relinquishing control – it means trusting our people to make the right calls and invest where it matters most.

When teams have ownership over their financial decisions, they not only work faster but also more responsibly. They know they’re being trusted to spend wisely, which increases accountability. Technology ensures we can still manage risk and compliance, but without the endless back-and-forth that delays execution.

2. Agility and responsiveness

Flexibility is key to a successful marketing strategy during a crisis. Market conditions can change rapidly, and your strategy should be agile enough to pivot when necessary. Continuously monitor the effectiveness of your marketing efforts and be ready to adjust tactics in response to changing circumstances. Agility allows you to seize new opportunities and mitigate risks as they arise. Source: https://www.star-digital.co.uk/blog/how-marketing-can-help-business-during-times-of-financial-crisis

In marketing, speed is crucial. Whether we’re responding to a competitor’s move, adapting to market shifts, or taking advantage of a sudden opportunity, the ability to act quickly can make or break a campaign’s success. Yet, so often, our hands are tied by slow-moving financial processes. Progressive Finance removes those obstacles by delegating decision-making and allowing us to respond in real time.

By automating processes with proactive controls, I can focus on strategic investments while trusting my teams to allocate resources as needed. With Progressive Finance, we can streamline processes and ensure we don’t miss out on valuable opportunities because we’re waiting for a sign-off.

3. Transparency and accountability

Of course, giving more autonomy to teams doesn’t mean sacrificing oversight. Progressive Finance emphasises transparency, which is essential in an environment where expenses need to be monitored. As a senior leader, I need to ensure that every dollar is accounted for, especially when finance, procurement and legal teams need and demand detailed reporting and compliance.

By using the right spend management technology, we gain real-time visibility into spending, ensuring that no budget goes off track. This transparency helps us stay compliant with procurement standards while also allowing teams the freedom to make quick, informed decisions. The balance of autonomy and accountability is key to making this approach work.

4. Innovation and experimentation

There’s constant pressure in marketing to innovate – but innovation comes with risk. In my experience, strict financial controls often stifle the creativity we need to stay competitive. Progressive Finance creates the space for innovation by cutting down on administrative roadblocks and freeing up resources for experimentation.

When teams aren’t slowed down by complex procurement rules or approval delays, they can test new ideas, explore emerging platforms, and experiment with bold campaigns. This is especially important in times of economic uncertainty, where the ability to pivot and innovate can provide a competitive edge. Progressive Finance allows us to experiment with confidence, knowing that we’re still operating within a framework of control and accountability.

Chief marketing officers (CMOs) see innovation as the path to growth, with marketing innovation now making up more than 20% of overall marketing budgets, according to Gartner, Inc. The annual Gartner CMO Spend Survey 2021 showed that 72% of CMOs have increased investments in marketing innovation over the last year. Source: https://www.gartner.com/en/newsroom/press-releases/gartner-says-marketing-innovation-makes-up-more-than-20–of-mark

5. Empowerment and engagement

One thing I’ve learned is that when your marketing team is empowered, they are more engaged and more productive. By involving teams in financial decisions, they feel more invested in the outcome. Progressive Finance enhances this by giving them the freedom to make decisions about their budgets. When employees feel trusted, their engagement and job satisfaction naturally increase, which leads to better results across the board.

The study of 50,000 employees by Inpulse found that 81 per cent of those who felt trusted by their line managers were engaged, compared to 28 per cent of employees who didn’t. The survey also revealed that employees feeling trusted and supported had the “greatest impact” on how engaged people were at work. Source: https://www.peoplemanagement.co.uk/article/1806097/employees-three-times-engaged-when-feel-supported-managers-study-shows

This is especially important for marketers, who often face tight budgets and high expectations for return on investment. When teams feel ownership over their budget decisions, they’re more motivated to make smart, strategic choices that align with the company’s goals.

The benefits of Progressive Finance for marketing teams

For me, Progressive Finance isn’t just about simplifying processes – it’s about empowering my team. And it’s about delivering better results while still adhering to all financial expectations. Here’s how it’s making a difference:

- Faster execution: By reducing approval delays, my team can act quickly on market opportunities and launch campaigns faster than ever.

- Smarter investments: With decentralised control, I can allocate resources where they’ll have the greatest impact, ensuring every investment delivers measurable ROI.

- Improved compliance: While we give more responsibility to the team, we still maintain full transparency and accountability, ensuring compliance with legal, financial and procurement rules.

- Increased innovation: Freed from rigid financial constraints, my teams can focus on what they do best – developing innovative, high-impact campaigns that drive growth.

- Higher team engagement: When teams feel trusted to manage their budgets and make financial decisions, they’re more engaged, which leads to better outcomes and stronger performance.

How I’m putting Progressive Finance into action

To make Progressive Finance work at Soldo, we have focused on building the right framework. Here’s how we are making it all happen:

- Set clear spending guidelines: We’ve implemented clear rules for financial decisions, including pre-programmed spending limits and approval processes that ensure compliance without creating bottlenecks.

- Invest in financial literacy: It’s crucial that every team member understands the company’s financial goals and feels equipped to make informed budget decisions. We’ve provided training and tools to support this, and we have an always-on enablement programme.

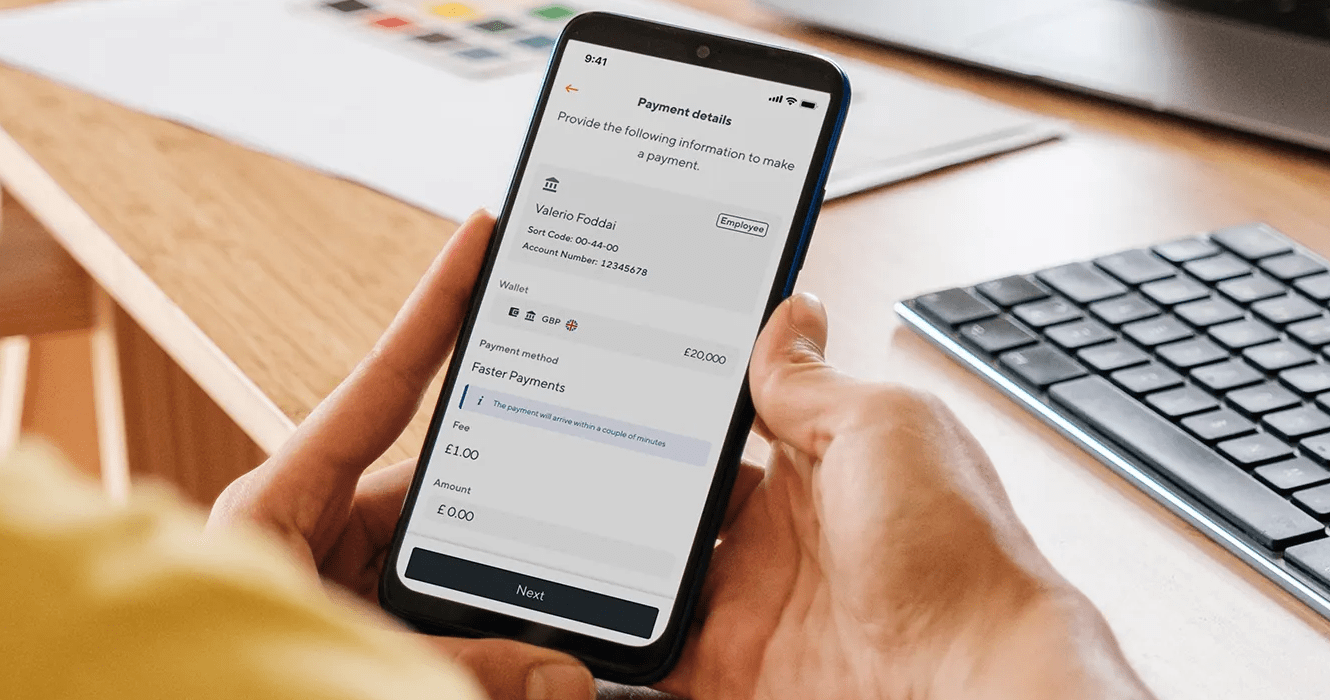

- Leverage spend management technology: We’ve adopted our own Soldo spend management platform and use it to manage all our decentralised spend. It’s integrated seamlessly with our financial systems and gives us and the finance team real-time visibility into spending while ensuring we meet procurement standards.

- Embrace new payment methods: We use pre-paid cards and virtual team cards to purchase goods and services that don’t fit easily into rigid procurement processes such as digital advertising, subscriptions, AI tools, sundries for events and more. It makes us more agile and helps us respond to changing needs quickly.

- Create a culture of trust: By fostering open communication and involving teams in financial decisions, we’ve built a culture where trust and accountability go hand in hand.

Why Progressive Finance is critical for marketing success

At a time when marketing budgets are under a lot of scrutiny, a Progressive Finance approach provides the flexibility we need without sacrificing accountability. It allows us to navigate strict procurement processes while still empowering our teams to innovate and respond quickly to business needs.

For me, Progressive Finance isn’t just a financial strategy – it’s a mindset that allows us to thrive in a complex, fast-moving world. It’s about giving teams the freedom to act quickly, invest strategically, and deliver results, all while maintaining the financial control and transparency we need to succeed. This approach is what will allow us to stay agile, adapt to market changes, and continue delivering high-impact marketing outcomes, no matter what challenges come our way.

Written by Isabelle Duarté

Isabelle Duarté is the CMO at Soldo. She leads the strategic direction for driving awareness and demand for the company.

With a multilingual and multicultural background, Isabelle has over two decades of experience building and executing marketing strategies for global software businesses like Okta, Symantec, BlueCoat and VMware.

Isabelle is fluent in five languages, and her obsession with technology crosses over into her love for Leica cameras and her one concession to fluffiness — her passion for Airedale Terriers and their canine cohorts.