While it’s impossible to imagine doing any financial task without using at least one spreadsheet, there’s no denying they’re clunky, prone to errors, and — let’s face it — outdated.

In the four decades since they became commercially available, technology has evolved by leaps and bounds. And modern accounting automation software can slash admin and enable your finance team to be more effective by orders of magnitude.

In this article, we’ll take a deep dive into accounting automation technology and outline the key reasons you should ditch spreadsheets and invest in it.

What is accounting automation?

Accounting automation is technology that can carry out tasks your finance team would otherwise have to do by hand, such as data entry, reconciliation, and reporting.

Imagine you wanted to find out how much you spent on marketing during the last quarter.

Without accounting automation, your team would have to compile a list of every marketing-related transaction for the previous three months — a process that could take weeks — confirm they’re accurate, then tot them up.

By contrast, automation software can track down all relevant transactions, verify them, and crunch the numbers for you almost in real time, with far greater precision.

Accounting automation isn’t a new concept.

Before digital spreadsheets were invented, making financial projections entailed writing out vast columns of numbers on paper sheets. And if you made one tweak, you’d lose most of a day (and probably several bottles of correction fluid) to recalculate everything.

Going back even further, there was a time when you could only do those sums using your brain and fingers. It was only when a young banker called William Seward Burroughs invented the first mechanical adding machine that calculations became simpler.

Without taking anything away from what Burroughs and other innovators accomplished, today’s accounting automation tools are far more powerful. Alongside basics like data entry, modern technology can perform sophisticated tasks like expense management and financial analysis with little or no human input.

More significantly, it can aggregate data from several different sources to give you a complete, real-time picture of your company’s financial health. And because most tools are digital and cloud-based, your finance team can access them from anywhere, as long as they have a device that can connect to the internet.

Which accounting tasks can you automate?

Basic accounting automation software has built-in commands and a control system that ensures those commands are followed properly. This makes it ideal for handling repetitive, rules-based tasks like:

- Recording and reconciling transactions

- Issuing invoices and payment reminders

- Verifying and paying expenses

- Working out your tax liability

- Closing out the month, quarter, or year

- But advances in artificial intelligence mean software is now able to learn from past data and make new connections.

As a result, accounting automation tools are able to perform increasingly complex tasks, like cash flow forecasting, spend analysis, and detecting expense fraud.

4 reasons you should start investing in accounting automation, well… yesterday

If what you’ve read so far sounds game-changing, it’s because it is. So you won’t be surprised to hear that investment in accounting automation is at the top of most CFO’s agendas.

Here are four compelling reasons accounting automation should be high on your list of priorities too.

1. Focus your efforts where it matters most

The single biggest benefit of accounting automation is that it frees you up by taking over time-consuming, low-value tasks.

As LogicGate CFO Kevin Jacobsen notes:

“Reporting the financials, understanding the financial metrics, making sure that we’re managing spend… That’s table stakes. You have to do it as efficiently as you can.”

The more important question is: how can you use your skills to impact those results?

With accounting automation in place, data entry, reconciliation, and other basic admin are no longer somebody’s — well, several somebodys — full-time jobs.

That means more time and resources you can dedicate to budgeting, forecasting, and other tasks that will actually help move the business forward.

But ditching manual processes is also important for another, more practical reason.

With the volume of data expected to balloon to a staggering 180 zettabytes by 2025, relying on manual processes is no longer sustainable. Jacobsen highlights:

“Technology has become that much more important for the finance person to be able to do what I do. The reason is… there’s just so much more data, right?”

Symphony.com CFO Ben Chrnelich agrees:

“Without a high level of technology, access, and development in financial applications, it’d be very difficult to provide the information to a wide group of people…”

2. Create a golden source of truth

Speaking of making information more readily available across the organisation, Connect Ventures CFO Mark Pettit observes that ‘It’s crucial that everyone … is looking at the same data when making decisions.’

This seems like common sense. Until you realise that manual processes — and legacy technologies that don’t integrate with each other — mean this often isn’t possible. Instead, the data is stuck in silos, so it’s hard to track it down and even harder to verify whether it’s accurate and up to date.

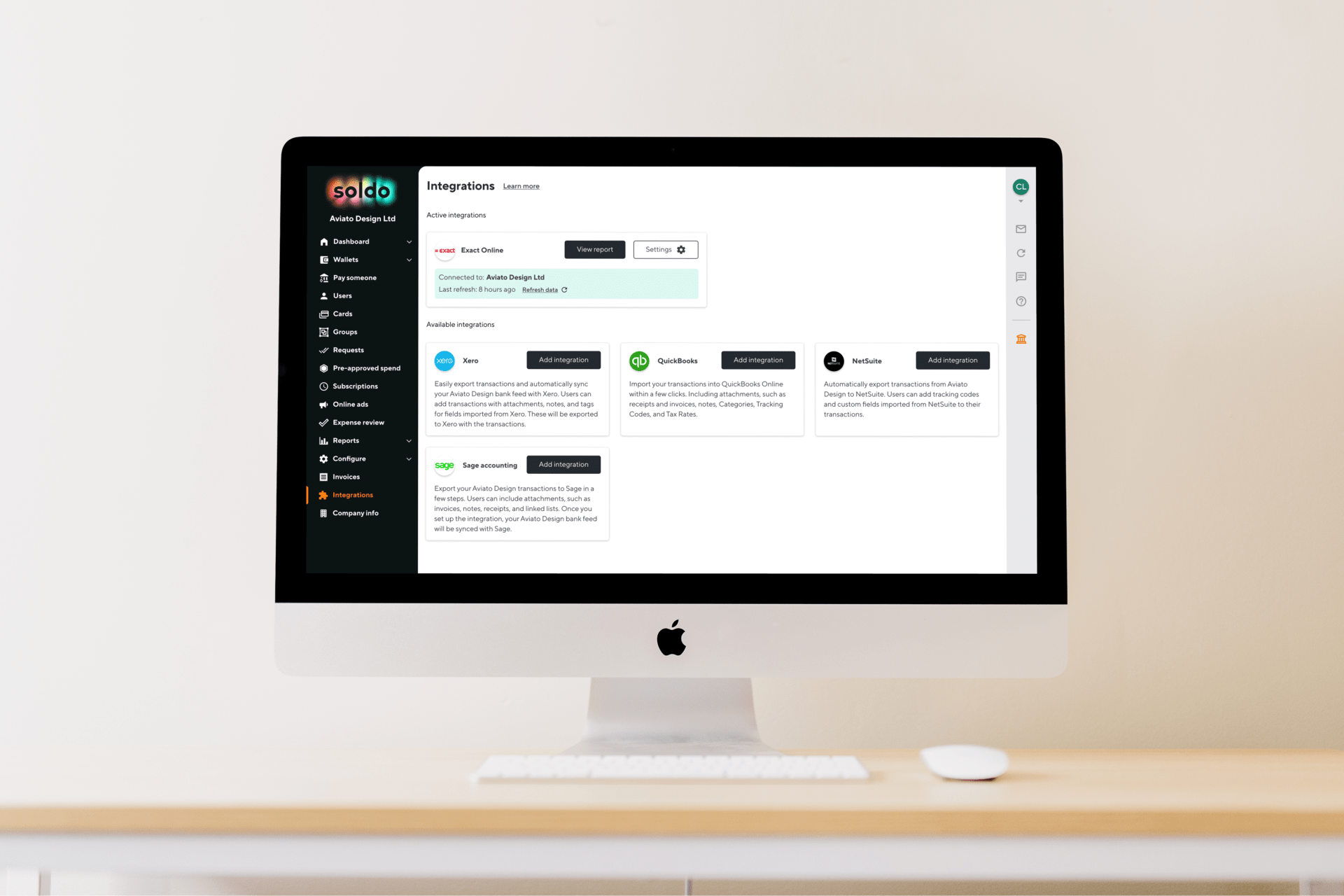

Good automation software talks to your other systems, making it possible to aggregate, organise, and store all your company’s data in one place.

And because finance teams have access to the business’ most sensitive data, they’re ideally placed to take control of the process and act as the company’s central repository. Alpha Medical CFO Kelly Battles argues:

“As the department with the most access to data, finance needs to take responsibility for [its] central management and advocacy… within a company. It’s then a matter of tracking that data and making it readily available across departments, so it can be helpful to everyone.”

3. Improve data accuracy

Silos aside, manual processes also create another critical issue: they’re susceptible to human error.

An often repeated statistic states that 88% of spreadsheets have at least one mistake. But what’s worse is that these mistakes often go undetected, with the result that 70% of global business leaders have made important decisions on inaccurate data.

Because accounting automation removes the need for manual input and checks, there are fewer opportunities for things to go wrong. Automation also gives you real-time visibility and a broader view. And, as Vena Solutions’ Darrell Cox notes:

“The more [data] you can get at, the more rich of a story you can get into… [and the better your] understanding of what’s happening.”

Crucially, when you don’t have to worry about your data’s accuracy, you can spend more time thinking about how to present it so it’s as easy as possible for busy decision-makers to quickly grasp the key issues.

Data, argues Mosaic’s co-founder and CEO Bijan Moallemi, ‘…has to be digestible. That does not mean a balance sheet or a statement of cash flow. It has to be consumable.’

4. Keep valued team members on side

The time-savings, cost-savings, and positive impact on your decision-making should be more than enough to persuade you to give accounting automation a try.

But, if they aren’t, consider this: frustration with outdated technology is a serious enough issue that almost half of employees are willing to quit their jobs over it.

This stands to reason.

We walk around with supercomputers in our pockets, can access any information imaginable in just a few swipes, and even get our Saturday night curry delivered to our doorstep by drone.

So why should we make do with technology from four decades ago when we’re at work?

As dotdigital CFO Paraag Amin aptly notes:

“By using software to do the tedious manual side of running the finances, you can free up your team to spend more time getting stuck into challenging projects, studying, and working their way up the ladder… “

And if your staff are happy and fulfilled, they’re more likely to stick around.

When people can grow and become more proficient at what they do, concludes Amin:

“You get much more back from them, and you’re going to have people who are more wedded to the business … who are happier in what they’re doing day-to-day… Ultimately, that works in everyone’s favour.”