There’s a lot to consider when scaling your finance team, such as making sure you keep your team engaged, that they’re not overwhelmed with admin work, and that you can provide top strategic insight. Digitisation is the boost your team needs.

We spoke with Paraag Amin, CFO of dotdigital, on the digital transformation they went through, its impact on employee engagement and performance, and what you need to do to scale your team successfully when your business is growing.

https://player.vimeo.com/video/556186378?h=9167873d16&badge=0&autopause=0&player_id=0&app_id=58479

Using digital transformation to fuel growth

Since its founding in 1999, dotdigital has changed dramatically. But its most significant growth happened more recently.

In 2014, the platform was relaunched with various new features. Over the past six years, their revenues quadrupled, and they’ve multiplied into seven different sales entities. And in 2019, they rebranded to focus on a move towards omnichannel marketing.

For a finance team to meet the demands of a growing business, its members need to be able to focus on the parts of their job that help the business move forward.

Tasks such as manual admin and data input aren’t just a huge waste of their time – they’re also mind-numbing. And they’re not a selling point for potential new joiners.

When Paraag Amin, their CFO, joined in 2018, he created an internal tech development unit dedicated to automating several finance processes.

And it’s worked out for them; they were able to invest a lot more in other areas of finance.

‘Digital transformation has been absolutely key to allowing us to grow now.’

The right tools will fast-track and optimise processes, reduce inaccuracies, and keep your team happy and focused on what matters.

Keeping up with growth

Paraag believes one of the biggest challenges for any finance function is to grow without increasing headcount.

As dotdigital’s key priorities lie in expanding internationally, their focus is on the issues and needs that come as a result of that. From opening bank accounts, to finding local suppliers and opening new offices, to ensuring compliance with local tax and labour laws – there’s a lot to keep in mind.

And because they are publicly listed, growing is essential.

‘We need to keep our shareholders happy. We need to grow our top-line as well as maintain – if not improve – operating margins.’

This raises three correlated points for companies in a similar situation:

- You need to meet and ideally beat market expectations

- You need to keep your team happy

- You need to ensure you’re growing without overstretching the business

All at the same time.

And for Paraag, the solution to these challenges revolves around the following question: How do you automate and optimise in other areas?

Business partnering and sharing data

When Paraag first joined, the finance function spent a lot of time pulling data out of systems due to a lack of business partnering.

Their CRM, ERP, and customer engagement platform had zero connectivity between them. The finance team was going back and forth between downloading CSV forms, manipulating the data, and piecing together information to send to departments.

‘That process was so cumbersome that, by the time you got round to doing it, it’s almost the next month and you’re starting on the next one and pulling data again. That to me just made no sense,’ Paraag says.

To simplify this process, they adopted a third-party data warehouse which allowed them to download the raw data from each of their systems and put it all into one.

This gave them the ability to start conversations with other departments – the finance team could go around the business each month to show the data and verify its accuracy.

After that, Paraag adds, ‘conversations tend to be around “What does this data mean? And what actionable ideas can we gather from it, if any, as we look forward?”’

As a perk, this workflow proves the finance team adds value to the rest of the business, and vice versa – ‘but all of that comes from not spending too much time trying to do the manual [work].’

Keeping employees happy

Paraag believes communication is fundamental in the process of scaling and optimising finance.

He says: ‘You win over hearts and minds. And, in order to do that, you need to resonate with the individual goals, the team goals, and then the business goals.’

So, how do you get buy-in from your team?

Paraag suggests you:

- Spend the first couple of months evaluating how you’re doing things

- Figure out which processes could be automated and improved

- Reduce the amount of manual work your employees do

- Increase the time they spend doing what can be considered value-add work

If you can digitise processes that have been manually done until this point, you’re showing your team that you want to improve their quality of life.

Automation gives them back time they can spend on forecasting, data analysis, and training to help your business in more interesting, innovative ways.

Investing in your team members’ personal growth and getting these tasks out of the way works in everyone’s favour, and increases loyalty:

‘You’re going to have people who are more wedded to the business, who are happier in what they’re doing day-to-day, who will be far more open to growing within that business.’

Easy ways to start automating

There are plenty of quick and easy-to-implement automated solutions to start with.

For instance, at dotdigital, two people used to oversee travel booking. And even though it wasn’t their full-time job, they still spent about half of their time on this.

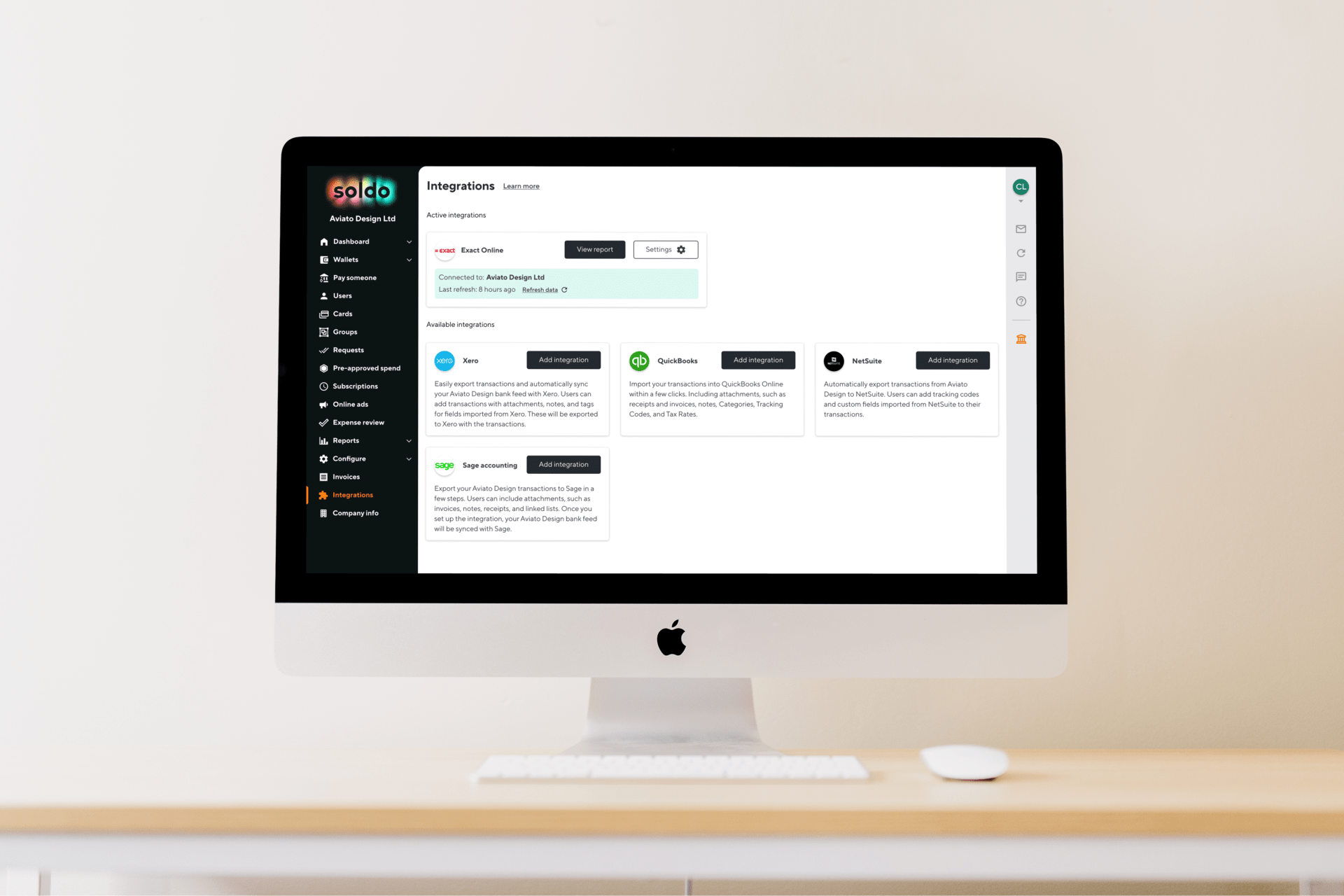

To fix this, first they got Soldo prepaid cards and began managing their company expenses and spending with the Soldo platform.

‘From a prepaid cards perspective, it ticked all the boxes. It gave us everything we need, from non-nominative cards through to the reporting. And the real-time reporting is absolutely key here.’

Being able to track spending meant they didn’t have to wait until the end of the month to see what was being spent – employees could spend while on the road, and their transaction data became instantly available. Plus, the integration with their accounting system streamlined the entire process.

Another simple tool that helped them make travel management easier was TripActions.

Before, when all their travel booking was done manually, they depended on constant communication with a travel agency. They had to deal with changes in rates and suddenly unavailable flights, which was terribly inconvenient. Going digital and using this tool has given them far more control and flexibility.

For the travel planning team, these were welcome changes that allowed them ‘to move those people into other roles and to actually do other things’ that could benefit the business.

Winning over stakeholders

Paraag says there are three key steps to follow when convincing stakeholders to invest in digital tools for the finance team:

- Explain what you’re trying to achieve, and get their input on what they believe is missing and what is being done well. For starters, talk to each department head and ask how you can help them. If you do, Paraag says, ‘they’re far more open and responsive.’

- ‘Demonstrate that you can [help].’ This might come down to, after those initial conversations, telling them what you can do with the information and why you think there’s value in it – especially the parts that they don’t immediately see as valuable. And through this, you can also let them know what you feel is missing.

- Get buy-in from one or two areas of the business, ‘demonstrating the value that you’re adding there, then using that as case studies internally to roll that out across the business.’ As Paraag tells us, there will always be people that aren’t as quick to embrace change and data in this way. But once you get some support, others will follow suit.

‘As a business, you can always look at how to improve that forward-looking element of the finance function, and becoming more of a business partner to other parts of the business.’

A more strategic finance function

If you’re trying to cut costs, reducing the amount of manual work being done and fully automating these tasks will save you money.

But digitisation will not only help you save time and money, it will also help your finance team play a more strategic role in the business.

By automating time-consuming, manual tasks, you free up your team’s time to do more value-adding work, and to deliver the insight that drives the business forward.

Get your copy of the Pay It Forward Playbook – your cheat sheet for business growth

In this free guide, finance leaders reveal the mistakes they made and the growth hacks they uncovered on the way to success.