Petty cash is a method by which businesses provide employees with money to pay company expenses. Traditionally, these funds are kept in a small cash box distributed in person and tracked with a petty cash book. But, as technology has evolved, the petty cash box as we know it has taken new forms – and for good reason.

Keeping a small cash box full of company money at your workplace is a big risk. Not only can somebody break the lock, but they can walk off with the box itself.

And managing petty cash is a time-consuming task. You have to keep a detailed account of every outgoing expense, any change that gets returned, the itemised receipts and the running balance. Even with your best bookkeeper on the job, the system is vulnerable to human error, fraud or abuse.

Fortunately, technology and banking have come a long way since petty cash was first used (over 200 years ago). In this article, we’ll outline the common security issues the traditional petty cash box presents and discuss the various cash-free alternatives that offer improved security, flexibility and accountability.

Petty cash box security woes

The design of an average petty cash box hasn’t changed in decades. It’s still a small cash box that comes with a cash drawer, cash tray, coin tray and built-in key locks.

While petty cash boxes do offer certain conveniences, like easy-storage and quick-access, the risks far outweigh the rewards.

Here are some common security risks regarding the traditional metal cash box.

- Theft from the petty cash box: It’s all too easy to steal from a cash box. It’s insecure, mobile and requires a great deal of employee trust to guard safely.

- Theft of the petty cash box itself: Thieves will take any opportunity to get their hands on a cash hoard, like your petty cash box.

- It’s difficult to keep accurate accounts: Cash, by its very nature, is difficult to track. The same goes for paper receipts. This leads to wasted time and money paying employees to manage this outdated system.

How petty cash boxes waste money

You can’t control, limit or easily track cash, making it easy for even the most well-intentioned employees to overspend. This is a big problem. The same holds true for credit cards with high spending limits.

Because cash is difficult to track and manage, petty cash boxes are prone to accounting and human errors. Whether it’s miscounting cash, poor organisation, or a lack of descriptive expense records on non-itemised receipts, small mistakes can add up to significant financial losses.

Fortunately, there’s a smart petty cash alternative that will help you save time and money, and you can spin it up in just one working day.

Get updated

Sign up to receive insights and industry best practices that will help you manage business spending the brighter way.

Soldo: the alternative to the small cash box

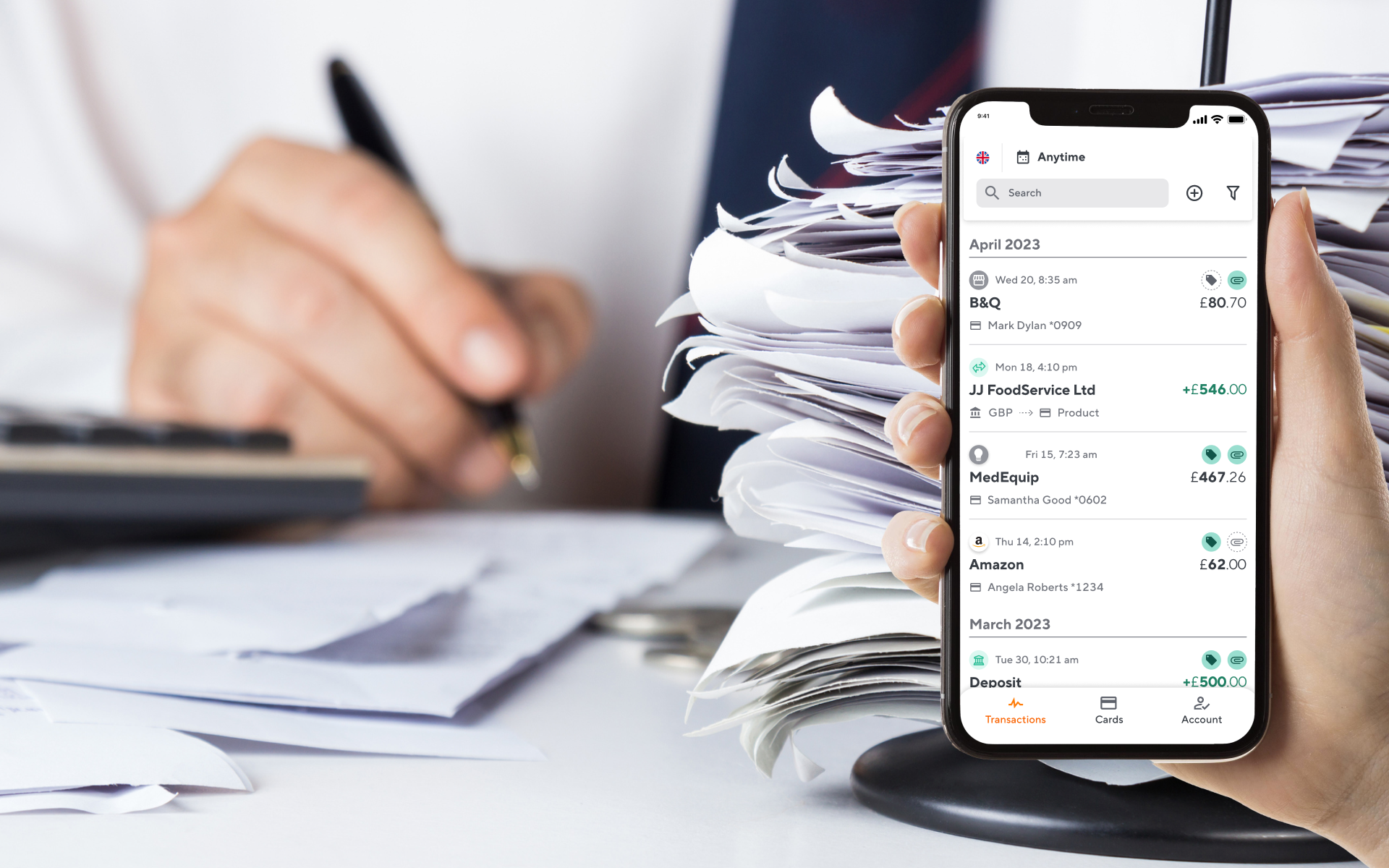

Soldo is a multi-user spending account that digitises your petty cash register.

Thanks to an intuitive software platform, you won’t have to make any more last-minute bank runs, organise paper receipts or worry about overspending, miscounting or theft.

Soldo works in real-time, so that you can track the exact location of your company funds anytime, from anywhere.

How does it work?

Soldo allows you to load specific amounts of petty cash onto a prepaid Mastercard card (both plastic or virtual). You can load an employee’s card from a mobile or desktop app in a couple of clicks.

Based on your preference, these allocations can be manual or automated with auto top-ups. This helps you to cut down on agonising admin time and cumbersome spend management processes.

Once allocated, you can track spending as it happens from your desktop web console. You can even integrate your accounting system with our software to simplify reporting.

When an employee spends petty cash, they’ll instantly get prompted on the Soldo app to upload the receipt. You can see this data and much more in the employee mobile app and administrative web console.

Improved security

Once you open an account for your company, you can order several Mastercard cards for your employees and departments. Soldo’s bespoke limits and controls allow you to tailor the settings for each card to suit the individual needs and permissions levels of each user.

This means you finally have a safe way to manage petty cash spend. These controls completely eliminate the risks that plague companies stuck using a petty cash box.

Not only can you set specific spending rules for each card, but you can change the balances instantly from the admin dashboard. This is useful if you need to update an expense at the last minute as it allows you to increase or decrease the spending limit immediately.

Advanced reporting

Instead of chasing down receipts and pouring over time-consuming expense reports from your employees, or tracking spending from your cash box using spreadsheets, you can export all the statement data you need with just a couple of clicks.

We provide statement, balance and transaction reports:

- The statement report shows line-by-line transaction activity similar to a credit card statement.

- The balance report allows you to easily check the balance on a user’s card, expense centre or wallet on any given day, which helps you gain a high-level overview of monthly spend.

- The transaction report gives you granular reporting of transaction-types and project-based spending so that you can assess spending across different parts of your business and stay on top of budgets.

Beyond our reporting tools, you can also integrate our platform with your preferred accounting system to further simplify expense management. We have full and seamless integrations with Xero, Netsuite and Quickbooks, as well as compatible exports into any accounting software.

Find out more

This is just the tip of the iceberg. Our platform is scalable, making it ideal for distributed teams of any size.

We’ve built a full-scale system in which cards, apps and a web platform work seamlessly together. With Soldo, you can manage expenses and spending in real-time from point of purchase to reconciliation.

Learn more about how Soldo can be used to replace your petty cash box.