Change how you spend

If you use debit or credit cards to track spending, you know that they lack the security and flexibility to be shared across the business, and that changing payment limits on them is a frustrating exercise.

And if your employees are paying for expenses out of their own pocket, the slow reimbursement process makes it an even bigger ask.

Soldo helps you manage business expenses and spending by offering prepaid cards (as many as you want) and intuitive apps which give your finance team granular control and visibility.

With the ability to manage each card in real time, including blocking them, Soldo is a safer option which lives between your trusted bank and the people responsible for payments – while making it easier for everyone in the business.

Coordinate spending with company structure

The way your company spends money should match how your business is set up – it makes tracking spending easier, and it’s a big step towards well-organised finances.

For fast-growing businesses investing in new hires, expanding departments, and branching out into new spending categories, this is particularly important.

Soldo’s refined wallet system gives you the flexibility to sort and divide funds that makes sense to your business structure.

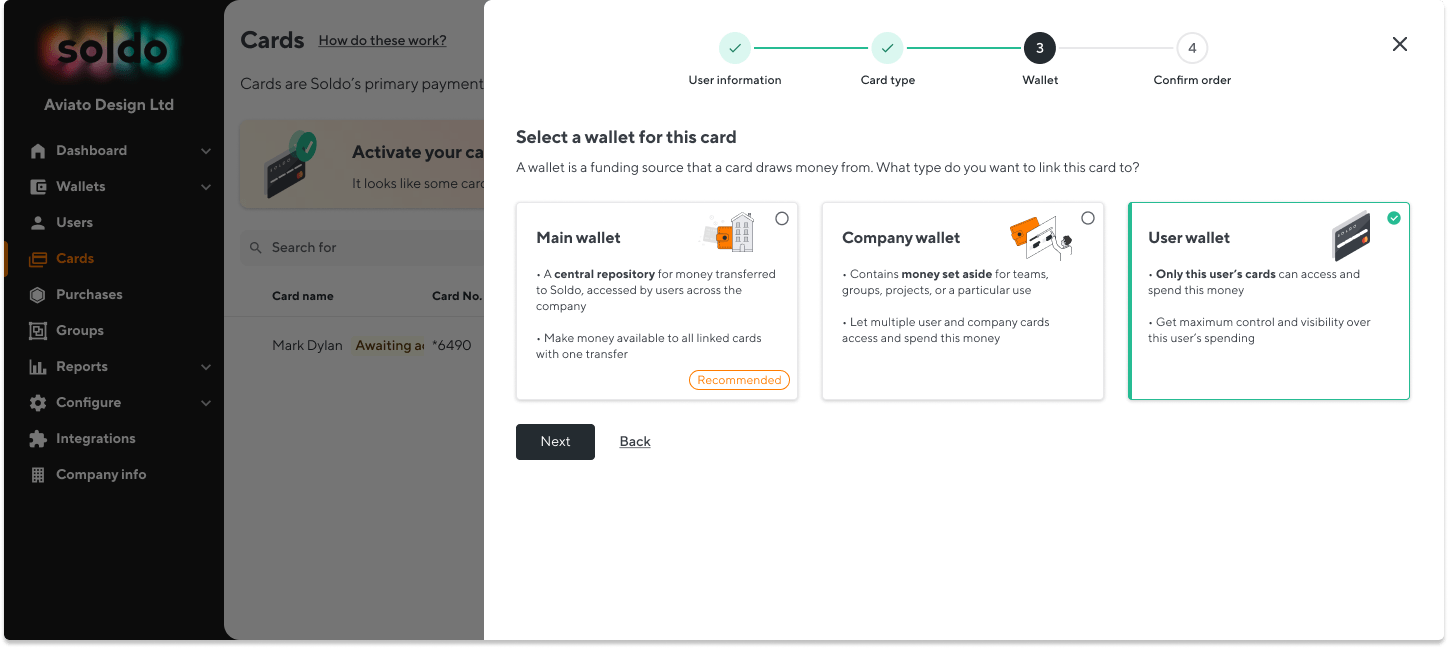

There are four types of wallets in the Soldo platform:

Main wallets – the wallets into which you deposit money from your bank account, which then can be transferred to other wallets, and/or use as a ‘funding source’ for multiple user cards or company cards.

Company wallets – used to fund a project, team, department, or even a specific spending category, in all supported currencies.

User wallets – associated with specific users, so that allocated funds can only be used by that person.

Reserved wallets – designed to provide a certain amount of money to a company card, so that the card has a separate funding source.

Creating different wallets according to your needs gives you more control over budgeting, so that you can plan for growth without worrying about where your money is going.

E.g.: If you have a monthly budget to cover online advertising costs, you can create a Soldo wallet for that purpose, place a chosen amount of money in it, and track ad spend in real time from the Soldo web console.

Sync up spending and accounting effortlessly

When keeping spending organised, visibility is key.

When keeping spending organised, visibility is key.

We surveyed over 250 founders and investors about their spending practices, and learned just how much this matters: around one in five said they don’t have the necessary financial insight to make spending decisions.

But if you’re manually wading through information, and waiting for the end of the month to reconcile expenses, then you’re not actively tracking spend and therefore delaying or misinforming decisions.

You can easily sync your employee expenses and receipts with your accounting software, so that you can see all your business spending in one place.

Rather than manually importing transaction information into your system – which results in data entry mistakes that cost the average UK business £252,992 each year– you can automate this process.

Here’s how it works:

- In the Soldo mobile app, users can capture receipts, lists, and notes at the point of purchase

- Users send transaction information to the platform with one click, on the go

- Soldo payments are automatically sent to your accounting software daily, so you don’t even have to worry about wasting time transferring information.

Simpler reconciliation does more than help you organise finances: it gives you a more accurate and complete view of spending, and allows you to focus on more important tasks which move your business forward.

See how Farmdrop uses Soldo to control costs without putting the brakes on their impressive growth.

Automate your expense reporting

Manual expense reporting invites several risks and opportunities for mistakes which can amount to serious money waste – business owners and finance leaders say that around 8% of VAT is left unclaimed annually, a fifth of this solely due to processing errors – and a big obstacle to growth.

In fact, 35% of decision makers at start-ups have referenced their inability to produce past financial data and forecasts as a problem when securing investment.

Inaccurate and slow expense reports won’t do you any favours, but an automated system such as Soldo increases employee accountability without impacting productivity.

One of the ways Soldo does this, as mentioned, is by allowing users to easily upload receipts and transaction information using the Soldo mobile app.

When someone in your company uses a Soldo card, admins get notified immediately, and the spend data you need goes directly onto your system.

For the finance team, this data is ready for reporting the moment the receipts are uploaded. For the user, the spending journey ends here – no need to submit more information or wait for reimbursement.

With Soldo acting as an automated expense reporting system, you speed up expense processing and gain complete control over spending.

Soldo offers two types of reports:

- Statement – a decluttered version of the traditional banking statement with standard information, split into three categories (monthly, custom date selection, and overall balance for specific date)

- Transactions – enhanced reporting with advanced filtering options, so that you can search transactions by wallets, cards, and fuel.

This type of reporting doesn’t just free you from chasing receipts and manually digitising and syncing spend at the end of the month – it’s also a far safer option which guarantees a better overview of where your money is going (and what that means in the long term).

Make card sharing easier for teams

One simple way of ensuring your company funds are appropriately distributed is to allow multiple people to access the same budget under one card, depending on its purpose or area of the business.

Soldo offers Company Cards which work like this:

- Designed so that different users who share expenses, such as office spend, don’t need to charge them under one employee’s card

- Staff can all use the same company card – which makes it easier for them to make purchases for their department and team (e.g., your marketing team might benefit from using a company card for digital ad payments, and your IT team might need another to keep track of software subscriptions)

- You have the flexibility to tie these cards to a shared wallet, so there’s no need to split funds among different wallets. Or you can give cards their own wallet to ring-fence funds.

Company cards make the payment and management process a doddle – employees don’t need to chase managers or the finance team to make a payment, and finance teams don’t have to play the guessing game to figure out which costs belong to which department.

This tool will free up time and funds to be used elsewhere so that you can continue to grow, while empowering your teams.

Get your expense account to fit your work

A better understanding of resource distribution and more control over cash flow are crucial when mapping your growth.

This includes:

- Knowing who is managing and spending for specific expenses

- In-depth cross-departmental comparisons

- More accurate forecasting

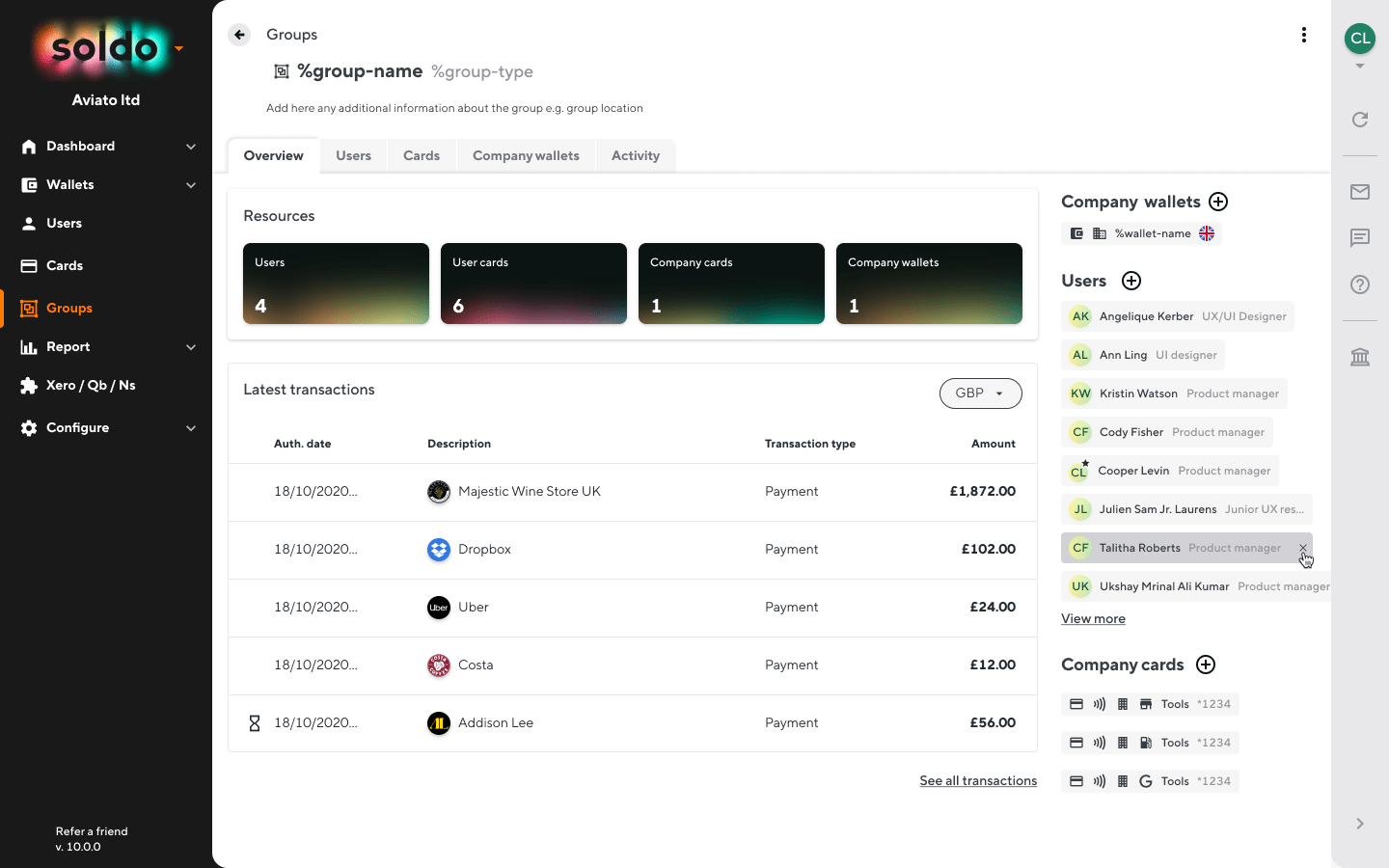

Soldo takes organisation one step further with Groups, a new tool which allows you to see multiple users, wallets or company cards that are part of the same team, department or project – and to manage them together.

You can group users the same way you would group people in your company, whether you want to monitor user spending on specific projects, or analyse different departments and teams.

When you look at a Group on your Soldo platform, you’ll:.

- See which resources (such as users or company cards) have been assigned to it

- Be able to add or remove resources as you see fit

- Easily identify each group’s transactions

Arranging your Soldo account to reflect your organisational hierarchy allows you to gather more insights on how company money is being managed, so that you can create budgets that make more sense to how you work.

Soldo grows with you

For start-ups and scale-ups, keeping spending on a tight leash is an imperative: investors will always want to make sure their money is in good care and will scrutinise how and where you’re spending it.

But seeing and controlling costs is difficult when you’re working with outdated, manual-heavy processes and lacking real-time information to keep you in the loop.

Using the right technology to automate your expense management system from payment to reconciliation across all areas of your business, you can streamline tedious admin work and gain the visibility and confidence to make smarter decisions.

With these scaling-friendly Soldo tools, you’ll save valuable admin time, limit waste from missed claims and processing errors, monitor spending discrepancies, and spot saving opportunities earlier – and you can continue to do so even when you’re bigger than The Beatles.

Discover how Soldo can help you grow

Watch our demo to see for yourself how Soldo works, including how easy it is to configure and manage your account.