How to manage your business finances

However, with a few simple tips and some careful planning, you won’t need to be a financial expert to learn the fundamentals and start making sound business decisions based upon accurate accounts.

Monitor your books

Successful businesses depend on careful financial management. Here’s why you need accurate bookkeeping:

- Provides reliable information for decision making and future financial planning

- Enables the completion of accurate tax returns

- Makes working with accountants, investors and lenders simple and straightforward

- Ensures that you can keep a close eye on cash flow and identify any potential fraud or problems on the horizon

Pay yourself

Paying yourself is not just about compensating yourself for your efforts, but it is an essential means by which to track the viability and profitability of your business. Start by taking 10% of any profits so that you keep both your business and personal finances in good shape and have a safety net, should any unexpected expenses occur.

Invest in growth

Any business should always have a focus on the future and investing in the longer term. Your employees will appreciate the investment in their careers, and you’ll add value to the business when you extract minimal profits for personal use. Set money aside for growth opportunities to ensure that the company is moving toward a healthy financial direction.

Measuring return on investment (ROI) will give you a clear view as to whether a given investment is worth continuing with or not. Don’t lose track of the degree to which your investments are performing for you and be prepared to cut back or redirect your spending when you have the bigger picture.

It is important not to wait until your business is in trouble to start applying for financing as this is the time when you’re least likely to be accepted for credit. Instead, use financing to leverage opportunities for growth that can protect your business from unexpected expenses.

Create good financial habits

Establishing good financial habits can protect your business against fraud and risk. The basis of sound financial management for your small business relies upon recording and reconciling every transaction. Whether you use accounting software or hire a bookkeeper, keeping track of every purchase, costs and income is critical to sound money management.

Employing a professional bookkeeper may prove to be invaluable if your business needs a range of financial services, including reports and performance monitoring. Talking to your accountant and tax advisor regularly can help with streamlining finances with tax-efficient planning and financial advice. When it is time for the business to expand, it will be done wisely and sustainably.

Invest in Technology

Bookkeeping software reduces human error and speeds up tasks such as paying bills and sending invoices through automation, allowing the firm to micro-manage cash flow.

Whichever system you choose, it’s essential to set up good financial practices and to make them part of your daily routine, including:

- Reviewing costs and businesses expense to fine-tune how money is used

- Staying on top of invoicing with strict payment terms

- Making precise financial projections so the firm can accurately anticipate any cash flow problems

- Using an expense management solution that lets you stay on top of day-to-day expenses while minimising the administrative overhead

Plan ahead

Businesses should plan with the mindset of not expecting to receive any business capital for the first three months once fully operational. This way, the company will survive the initial startup phase without needing to blur the line between business and personal finances.

As a business owner, you’re legally required to have employer’s liability insurance, but there’s a range of additional protection that may be relevant to your business. Begin planning now as to what type of cover your business may require to stay protected while it grows.

Keep business and private accounts separate

Presenting an accountant with mixed and incomplete accounts can be a significant cause of stress. Separating business and personal finances from the outset will help the company to be as tax efficient as possible and help prevent surprises at filing time.

The best business bank accounts will help you keep track of profitability and expenses, and your bank will often throw in some useful free business services, so take time to seek the best deal.

Save on utilities

Taking the time to find the best deal from internet and energy providers will save money that could otherwise be lost by not periodically reviewing contracts. It’s money that can be better used for creating an emergency fund for times when cash flow lets you down.

Keep travel costs low

Don’t overspend on luxury travel as it can set the wrong precedent for employees. Keep employee expenses to a minimum and plan as if the costs were being paid out of personal finances. This future proofs the business against lean periods and gives greater flexibility to deal with the unexpected.

Don’t spend prematurely

Don’t risk premature spending on expenses such as signwriting, company vehicles and inventory that can create an instant cash flow issue. Instead, focus on making debt reduction your number one priority as bad debts can adversely impact your credit rating. Write them off as quickly as possible so that you can present the most favourable financial picture possible to potential investors or acquirers.

Starting a new business is all about balancing risk and opportunity. Sound financial management is essential in maximising your chances for business success.

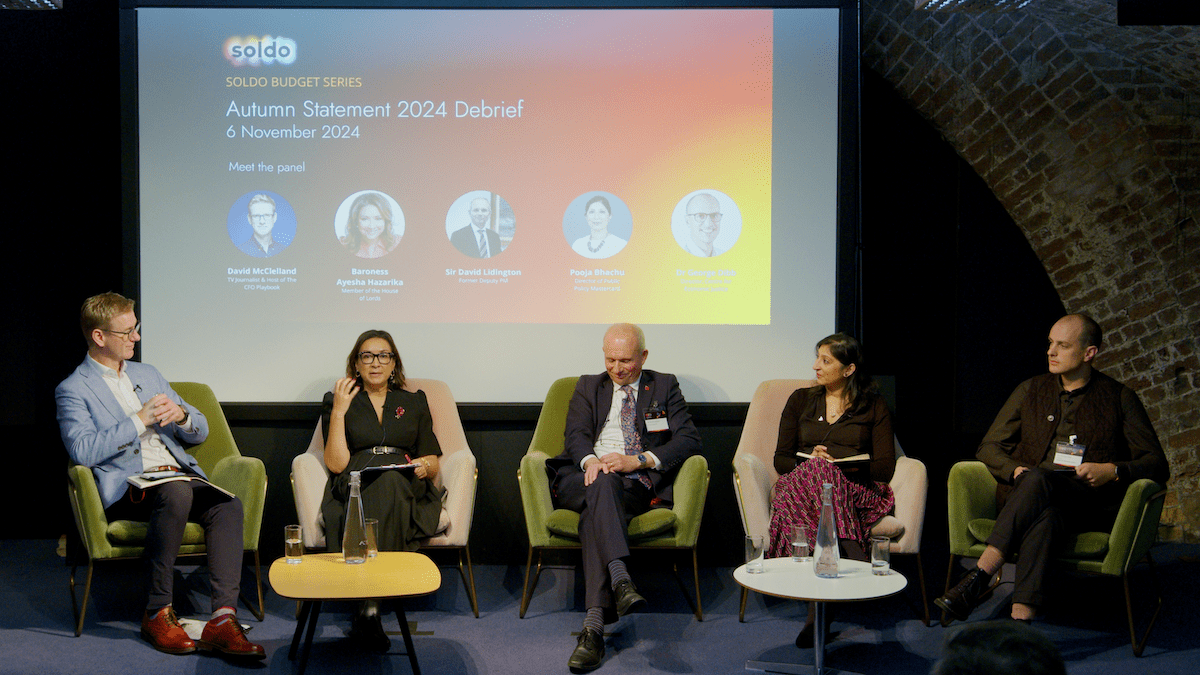

Ready to take control?

Sign up today, and discover just how simple your expense management could be.