A prepaid card is a smart way to keep track of your employees’ expenses. Often offering better exchange rates, a prepaid card is an excellent alternative to a low FX business card or carrying cash, and an innovative solution to ever-increasing business travel costs.

How prepaid cards for international business travel work

Before any business trip, a prepaid company card can be preloaded with your travel expense budget, including any necessary client entertainment costs. The card then works in the same fashion as a debit card and can be used to make purchases and withdraw cash. Cards can even be topped up externally in the event of an emergency.

What types of prepaid travel cards are available?

There are three types of prepaid business cards available depending on the locations to which employees are travelling and the currencies in use:

- Single currency This type of card allows the business traveller to buy currency upfront, locking in a favourable exchange rate. However, exchange rates can fluctuate, so there is a potential of losing out if the pound strengthens.

- Multi-currency Multi-currency cards are ideal if an employee is visiting more than one country. The main benefit of this type of card is the ability to load cards with several different currencies including sterling, euros and dollars.

What to look for in a prepaid card

When contemplating using prepaid cards for business travel, consider the following options in choosing the best card for specific business requirements:

- Available currencies that reflect the destinations

- Support from a credible payment provider such as Visa or Mastercard

- Competitive exchange rates

- Cash limits and budgeting tools

- Fees that might include loading fees, exchange rate fees and withdrawal fees

Prepaid card vs credit card

Credit cards can often offer a foreign exchange rate that’s very close to the bank rate and may even provide insurance on purchases. However, in the context of business travel, credit cards have two significant drawbacks:

- Costly cash withdrawals Businesses may be able to find a credit card with a 0% usage fee. However, with cash withdrawals firms could end up paying a higher rate of interest, plus a cash advance fee.

- Interest Instead of planning business expenses upfront, firms rely upon credit. If they can’t repay the entire amount, then they’ll end up paying interest, in contrast with a pre-loaded prepaid card.

The benefits of using a prepaid card for business travel

With an easily managed prepaid card, businesses can bypass many of the inefficiencies and hassle of traditional business travel. Streamlining processes, including administration, reduces overall travel costs while the security and convenience of card payment reduces the need for cash and traveller’s cheques.

This innovative travel solution offers a range of benefits:

Benefits for employees

- Safer than cash as the card can be cancelled if it is lost or stolen, giving business travellers security and peace of mind.

- Greater flexibility to pay by card or withdraw cash that is accounted for upfront

- Employees are no longer expected to use their own cash or credit cards to cover their expenses, leaving them out of pocket

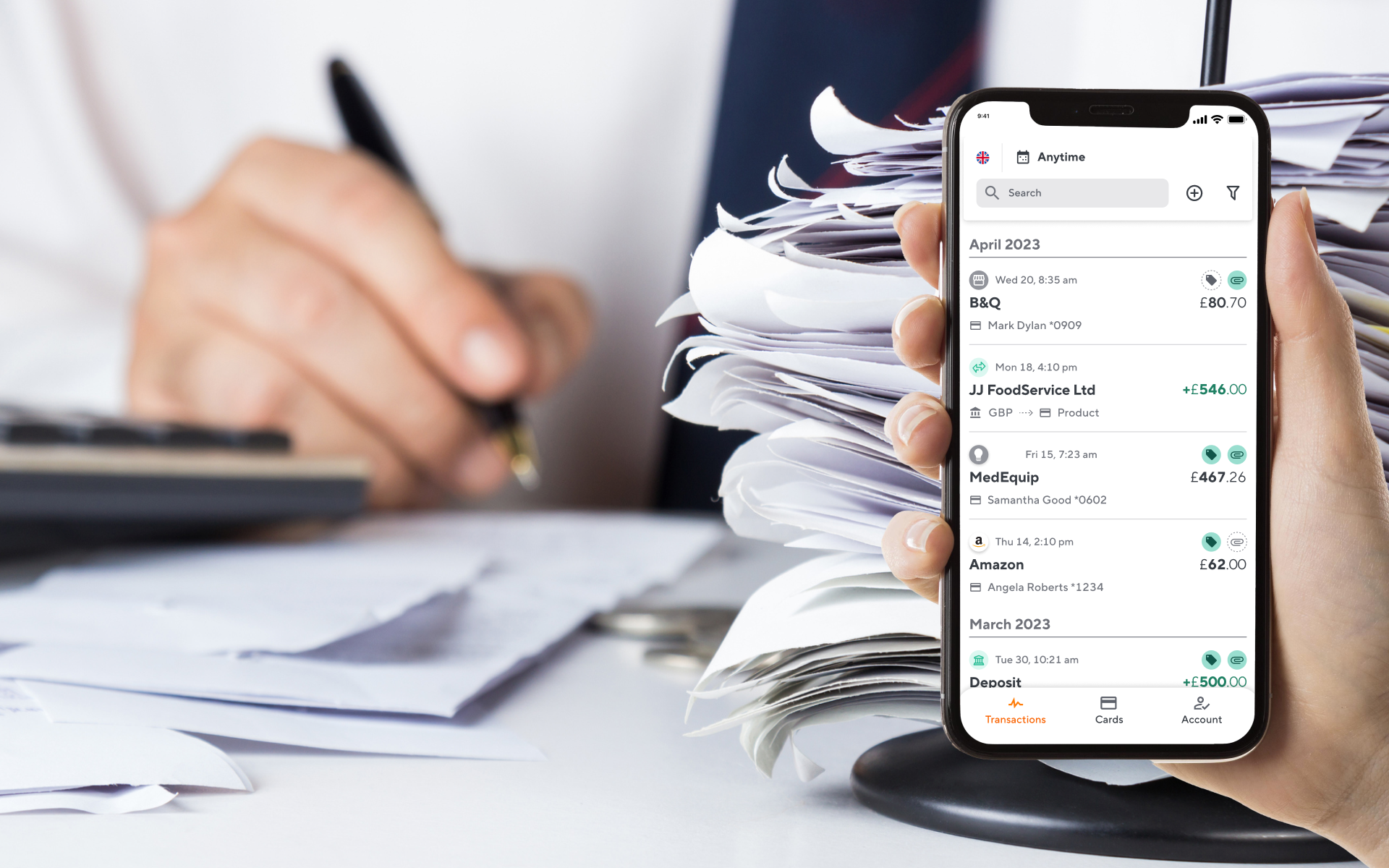

- The ability to control and keep track of business expenses and streamlines expense reporting as there’s no longer a need to hang onto paper receipts

Benefits for businesses

- Substantial savings on interest rates and exchange fees

- Greater financial control and reduced waste through maximum load amounts and withdrawal restrictions

- Pre-budgeting for an entire trip allows managers to make informed decisions regarding future business travel plans

- Prepaid cards for businesses backed by recognised providers are accepted worldwide by hotels and restaurants

- Zero Liability protects businesses and employees if the card is lost or stolen after registration

- Simplified money management and streamlined travel processes that save your business time and money

Greater flexibility and control

If an employee needs to spend money whilst abroad, a prepaid card puts managers firmly in control. There is no need for credit checks to acquire a prepaid card or a virtual company card. Prepaid cards provide all the flexibility of a business credit card with none of the hassle. It is therefore little wonder that prepaid cards are an increasingly popular choice.