Credit card bills are just a long, long list of transactions, and can be completely meaningless. If you don’t immediately know who spent what (and why), the likelihood is that your company accounts department is wasting precious hours on corporate expenses detective work.

What do we mean by corporate expenses?

Corporate expenses are purchases made by the company itself, rather than employee expenses, which individual staff members incur in the course of their work.

Examples of corporate expenses include:

- Office stationery

- Refreshments

- Online software subscriptions (such as Microsoft Office 365)

However, this list makes corporate expenses look a little simplistic.

Take this example:

Suppose Team A has to buy refreshments for a meeting. They want to impress a potential client, so they steer clear from the usual sandwich suppliers and go for a boutique delivery service.

The team leader gets authorisation for the purchase, writing ‘Refreshments for client meeting’ on the dockit. Later that month, the credit card bill arrives, with a £74.65 listed as having been spent at ‘P & P.’

The person responsible for checking the credit card bill is completely baffled, having never heard of this niche supplier, so they spend an hour asking around – who spent £74.65 at ‘P & P’? Or perhaps it’s Postage and Packaging?

Nobody knows.

Team A’s leader is out of the office until the following week and it’s pointless Googling ‘P & P’.

The accounts employee then picks up the phone to the credit card company to finally discover what the expense was for, and then calls ‘P & P’ for more information.

Satisfied that the expense was genuine, the mystery of who spent this money still stands.

What’s worse is that precious staff hours have been wasted.

This type of situation is extremely common – and not only to corporate expenses.

The problem with corporate expenses

Part of the problem is that credit card bills just don’t contain enough information. And if they do contain information, the information has no meaning, context or evidence to make it useful.

But beyond that, there’s another problem.

Too many cooks spoil the broth

All too frequently, companies rely on the use of a single credit card to make all of their corporate expenses.

One credit card, with several users. No wonder the average corporate credit card bill is replete with mysteries.

Some companies do this because they don’t want to (or can’t) exhaust a limited credit line with their bank.

Still more companies just haven’t caught up with the demise of the invoice > bank transfer billing model.

Before the days of online shopping and e-billing, it made sense to use a single credit card for all corporate expenses.

But times have changed since then, and companies now need an easy path out of the chaos.

One card just isn’t enough

We’re not talking about giving a payment card to each member of staff – that would be overkill. Although there is a safe and efficient way to do it if that’s what you want to do.

But think of it this way – if you can give a card to a human being, why shouldn’t you be able to give one to a regular purchase area?

Imaging if you could dedicate a card to Office Stationery, for example.

The bill arrives at the end of the month and, whatever strange supplier names you see on it, you know that all of the transactions were for office stationery.

It’s a bit like the concept of ‘cost centres’, but far more fluid. One cost centre may warrant more than one such dedicated card, and these needs may change with time.

Introducing the Company Card

Soldo Business has a simple solution to credit card mysteries.

We call it the Company Card.

A company card can be anything you want it to be. To use the examples stated earlier, you can configure Office Stationery, Refreshments and Online Software as company cards. Only you know which cards your business needs to keep its corporate expenses clear and simple.

Cards with bells on

Soldo Business Mastercard cards do far more than let you spend money – that’s the easy bit.

And if we were only about giving you as many cards as you need, without any restrictions or control, it wouldn’t be very prudent.

That’s why our cards work in tandem with an easy-to-use online dashboard which puts you in control at every step of the corporate expense journey.

You can set bespoke budgets, limits and rules to fit every user or company card to perfection. You’ll be able to see at a glance what everyone’s balances are, and everything is shown in real time, all the time. We’ll send you instant notifications every time someone spends money or makes a cash withdrawal.

Then, at the end of the expense journey, you can get exportable expense reports with only a couple of clicks.

Bringing corporate expenses into closer focus

But even the bill from an exclulsive ‘Office Stationery’ credit card could still contain mysteries, right?

Not with Soldo Business.

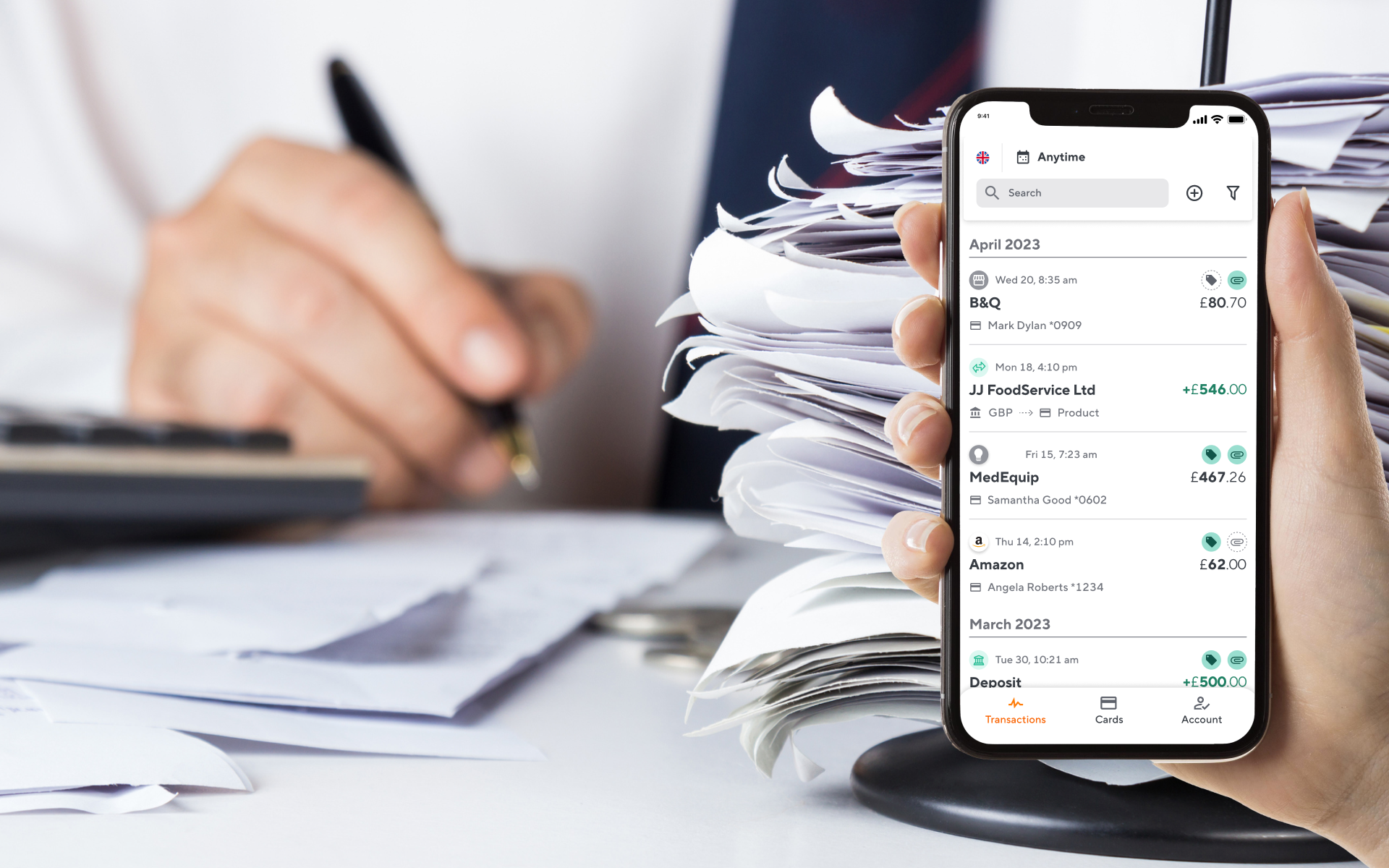

With Soldo Business, your staff have free access to an app which effectively makes them effortless contributors to the corporate expense reconciliation process.

They can upload notes to each transaction (e.g. ‘Sandwiches from P & P for the meeting with prospective client X), and even photos of receipts. Your accounts staff won’t have to waste a single moment trying to figure anything out.

And, if you want to further refine the reports you can generate, why not create a series of tags which your employees can then click on to neatly categorise each spend.

How do tags work with company cards?

Let’s say you have the three cards mentioned above. For each of them, a different staff member makes a purchase in support of Project X.

We don’t think you should have to scour your bills for Project X expenses – that’s just yet more time wasted on pointless detective work, and that’s not what we’re about.

Instead, each employee added the Project X tag to their respective purchase. Then, at the end of the month, you can generate a report listing all corporate expenses associated with Project X.

Simple, easy, and clear.

You can now try Soldo Business FREE for one month (no contract or obligation) to find out what Expense Centre cards can do for your business.