Asking employees to pay for expenses upfront is commonplace, and there’s no law against it. As with many practices, there can occasionally be a disconnect between what is legal and what is just or fair.

When it comes to expense policies that feel unfair, there are shades and nuances, and it’s a good idea to take a look at these to see if you might have scope to negotiate something that makes you feel less rankled.

How much, how often and how long?

The first question to consider is the value and frequency of business spending you’re expected to put on your own personal credit card. If it’s just the odd T&E expense – lunch and a (reasonably priced) train ticket, then you probably don’t have much room for manoeuvre.

If you’re regularly having to splash out on conference, train or even plane tickets, this is completely different matter. If such spending is having a real impact on your personal finances, you’ll need to speak up.

The other factor to consider is how long it takes for your company to reimburse you.

Asking people to wait until the end of the month for reimbursements that might total into the high hundreds is likely to put some noses out of joint – particularly if the company’s reimbursement arrives after your credit due date. If this happens, and you do end up in default, then it’s very important that you do speak to your boss, as the default could have a negative impact on your credit rating and impair your ability to get credit in the future.

When you’re not senior enough to get a company credit card

One of the thornier aspects of this problem is that, if you don’t have a company credit card, it’s often because your company only allocates company cards to senior, or even board level, staff. The difficulty here is that if you’re not ‘senior enough’ to get a company card, you’re also likely to be earning less, which means that paying up front causes a greater burden.

How to approach your boss

First of all, you should check your employment contract and any expense policy, to find out exactly what expectations are in your case, on both sides.

The problem with approaching your boss about having to pay up front is that you might feel slightly awkward being honest about your financial situation. The good news is that you don’t need to divulge too much personal information in such discussions.

The best approach is simply to chat to your boss, and say, “I really want to go to this conference and represent the company, but I’m not going to be able to pay for it upfront. Do you have any suggestions?”

If you position it like this, in a positive way, it’s likely that your boss will want to work with you to come up with a solution that works for everyone.

A spoonful of sugar

In theory, you could actually turn the situation to your advantage by shopping around for the best credit cards that offer rewards such as air miles and other points. Historically, there’s been some uncertainty about whether an employee, or the company, owns any points earned while paying up front and getting reimbursed later. However, HMRC has ruled that not only do employees have a right to such rewards, but also that these are not taxable.

There is another way

Nevertheless, even with a huge hoard of points that get you half the way from here to Australia (Dubai, anyone?), if your employer is slow to reimburse you, then your credit rating could still suffer.

Now for some good news.

There is a better way for everyone – a way that will keep everyone happy and make managing the company’s expenses easier all round.

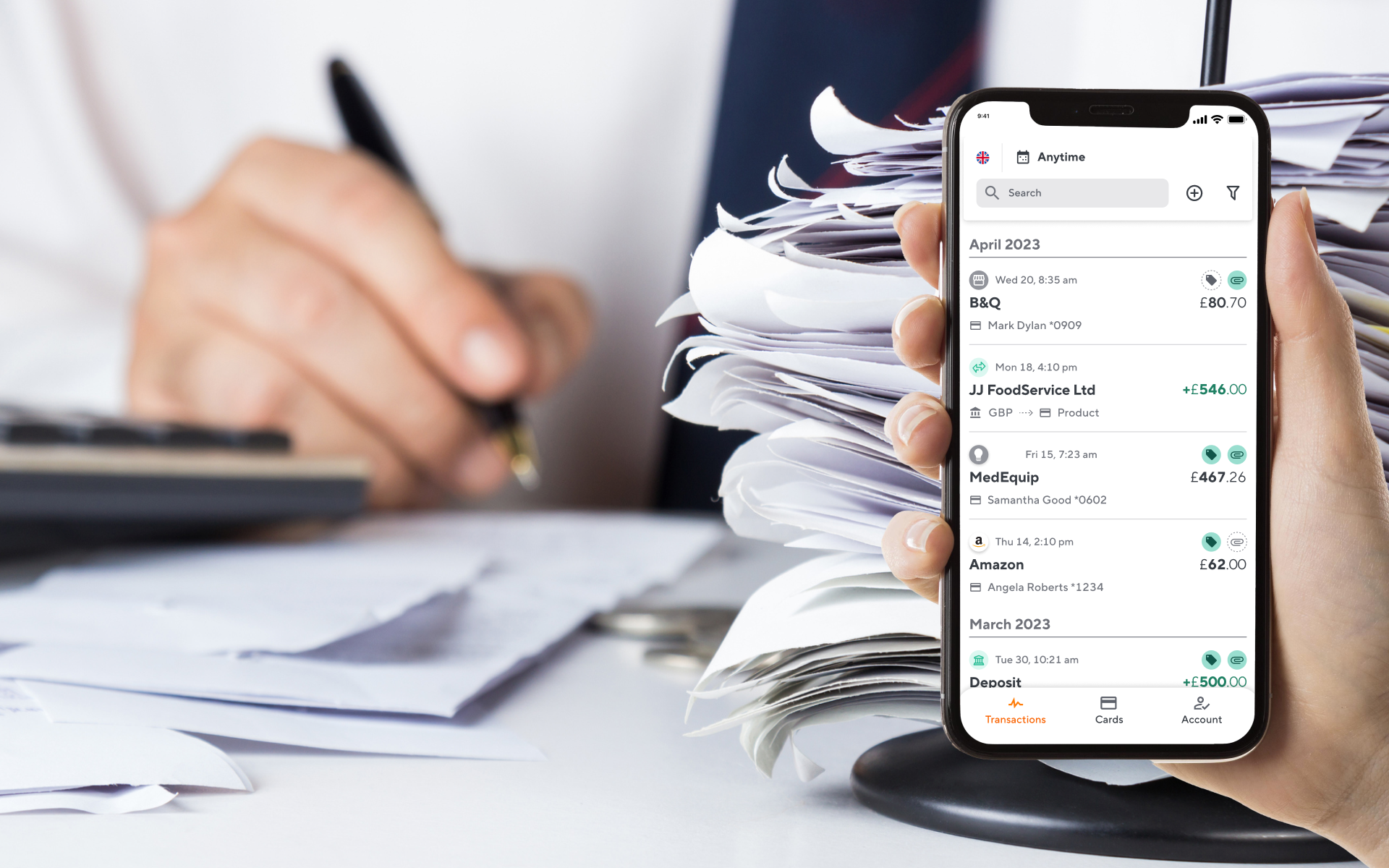

Soldo, the business spend control platform, features integrated Soldo Mastercard® cards, a web-based admin dashboard and a mobile app.

Your boss will be able to control everything from an easy-to-use admin dashboard, seeing at a glance who is spending what, on what, where, and even why. Not only is this great for the company, but it’s also great for you, because the extra security means that your boss will feel more confident than ever giving you a company card from Soldo.

Learn more about Soldo today from our website, and feel free to share it with your boss.