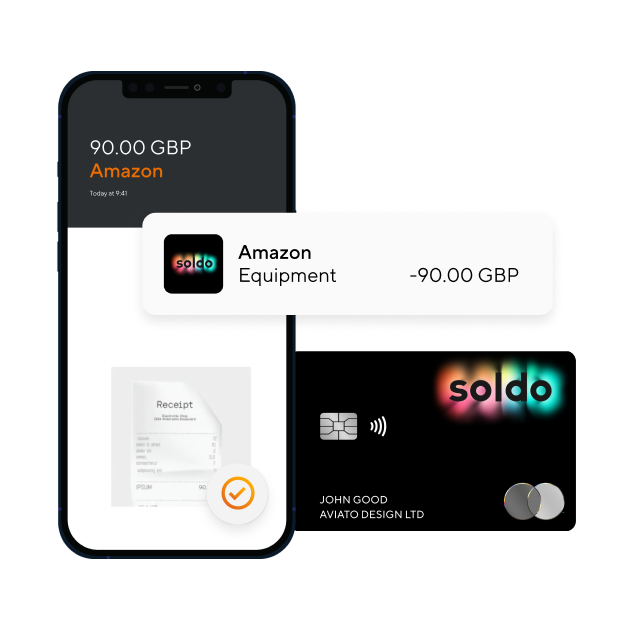

What are prepaid corporate cards?

Corporate or business prepaid cards are the modern, easy way to manage your business expenses. No more sharing business credit cards or having your team pay with their own cash and be out of pocket until they’re reimbursed.

Their key benefits are ease and flexibility. Just add money to a central company wallet, then allocate cards and funds to your employees who need quick, convenient access to money.

The cards work like regular debit cards for making purchases or withdrawing money, but only up to the amount you add and allocate. It’s easy to see and control what they’re used for and top them up as needed.

What are prepaid business cards used for?

Prepaid cards for businesses give your management and finance teams complete visibility over spending, without taking accountability away from your staff. You can use a loaded card in any situation in which you’d use a debit or credit card, including in-store, contactless and online payments.

For example, you might give a budget to your salespeople on the road, removing the hassle of expense claims for travel, meals or client entertainment. Or you could give everyone an individual equipment or learning fund. Alternatively, handle recurring subscriptions and online ad spend seamlessly.

How do business prepaid cards work?

Prepaid business cards enable you to give cards to employees and departments that need them. You decide how much cash gets allocated to each card and where it can be spent. You can then manage every aspect of the cards from your login. After that, it’s up to your staff to decide how to spend their budgets – within your rules and limits, of course.

What’s the difference between a prepaid business card and a credit card?

The biggest difference between a prepaid card and a credit card is that prepaid cards don’t need any credit to work. The money you add and use on a prepaid business debit card is all your own, rather than having to borrow and repay money through a credit facility.

This brings two major advantages: there’s no debt involved, and no restrictions on who can use them – all you need is a registered company name. You don’t need to worry about credit checks, running up debt or limited card availability.

Are prepaid business cards safe?

Prepaid business cards are one of the safest ways to manage your business spending.

Unlike regular business debit cards, prepaid cards don’t give users access to your main company account, so you keep control over what your staff spend. You can set rules and limits by location, merchant type or spending channel, for example. And unlike credit cards, there’s no chance of getting into debt.

Your money stays secure with Soldo too. We’re authorised and regulated by the Financial Conduct Authority (FCA), so we follow strict compliance processes such as only accessing your funds to execute your transactions. Your money is kept separate from our own business bank accounts and safeguarded under the UK Payment Services and Electronic Money Regulations. Learn more about security with Soldo.

How much does a prepaid business card cost? Are there any fees?

You can get started with a Soldo prepaid business card with the Soldo Pro plan. That gets you access to all our core features, including a mobile app and desktop platform. There are no fees for deposits or transactions.

If you need advanced features like extra controls and reporting, you can sign up for Soldo Premium. We also provide prepaid cards for enterprises with extra integration and support to conquer complexity.

Find out more about pricing or request a call back for more information about our enterprise prepaid cards.

How do I load money onto prepaid cards for employees?

You’ve got three options for adding money to your company wallet:

- Bank transfer – up to 24-48 hours for GBP and EUR, up to five working days for USD

- Faster Payments (BACS) – typically immediate

- Paypal – up to 30 minutes for instant transfers, within 3-5 working days for standard transfers

Once the money arrives, you can add funds to your employee or team wallets instantly. You can also set up automatic top-ups to save time and effort and make sure your team aren’t left short.

Can I withdraw cash using a prepaid employee expense card?

You can withdraw cash using our prepaid corporate cards, just like you would with a regular business debit card – within our withdrawal limits. As a Soldo account holder, your limits may vary and are shown in your web or app login area.

How do I check the balance on employee prepaid cards?

You can check your real-time balance through your web or app login in just a few clicks. See what funds are available on multiple cards and currency wallets instantly. You can also check your balance at ATMs or by text.

Can I use a prepaid card for business online?

You can use prepaid debit cards for business online or in-shop to make the same purchases you would with a regular debit or credit card. We offer prepaid cards and virtual company cards. They’re almost identical to traditional prepaid cards, but instead of sending you a physical card, everything’s online.

Can I use prepaid business cards for international payments and payments abroad?

Work across borders? You can use our cards for international payments and payments abroad too.

You can set up company wallets in GBP, EUR or USD to manage your offices around the world. We’ll then issue cards in these currencies, with a small foreign exchange fee for using one to pay in a different currency. Mastercard® Soldo cards are accepted by millions of merchants worldwide.

Can I issue multiple business prepaid cards for employees?

Whether your business has 2 employees or 20,000, our prepaid business expense cards are for you. They’re easy to scale up or down too. You can give cards to some or all your employees and even external collaborators, empowering them to spend within your limits.

Do prepaid business cards in the UK affect credit?

Prepaid cards don’t involve applying for or using credit in any way, so your business credit score is unaffected. This also means you don’t need a certain credit score to access prepaid cards for your employees.

Can I go overdrawn on prepaid business cards?

Unlike a regular business debit card, you can’t go overdrawn on our UK business prepaid cards for employees. Your team can only spend as much as you add to their wallets and no more (until you top them up).

Is Soldo a business bank account?

No. Soldo provides extra spend management features that work alongside your business bank account, instead of replacing it. You can use your Soldo cards to separate staff spending from your main company funds, as well as access powerful features that aren’t available with any banking provider.