What Is a Business Credit Card?

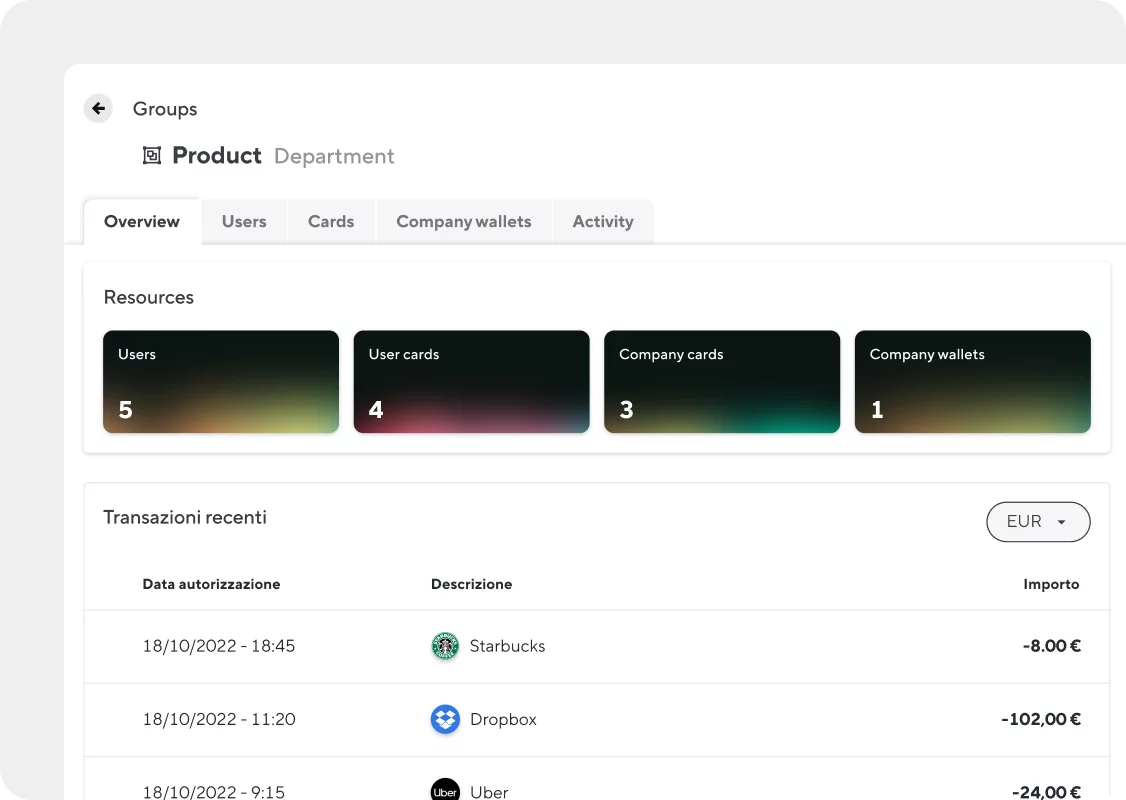

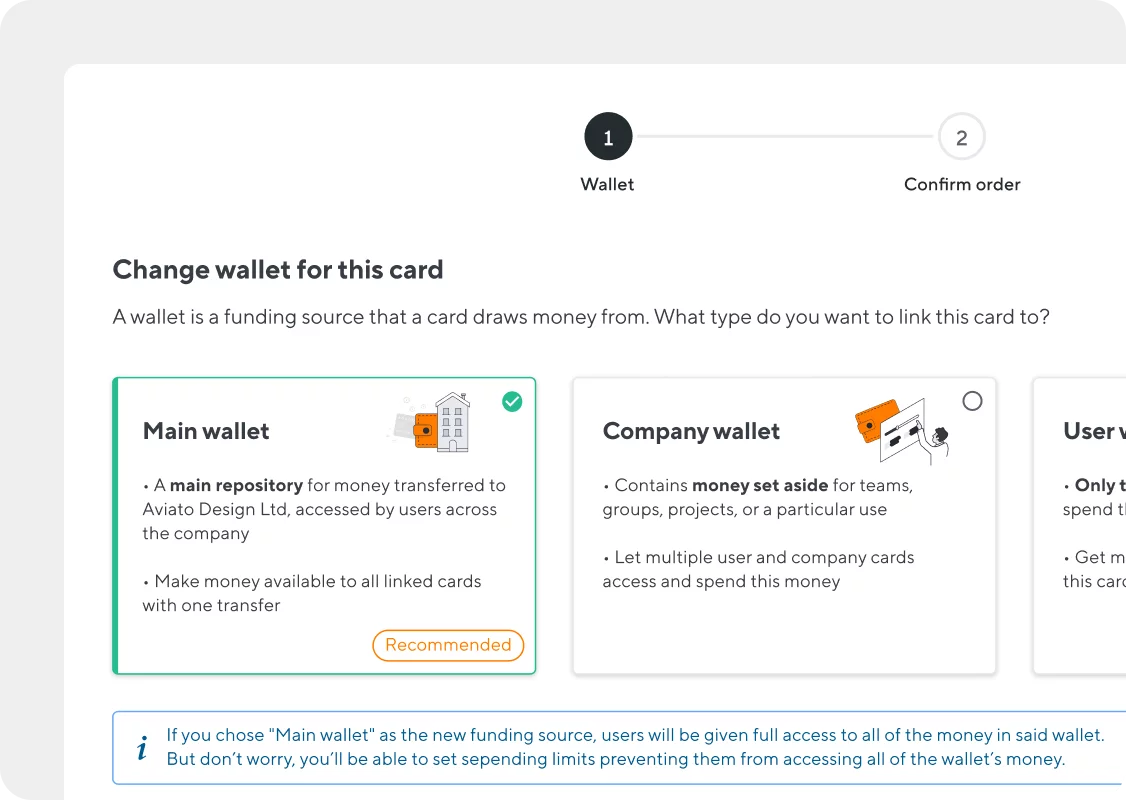

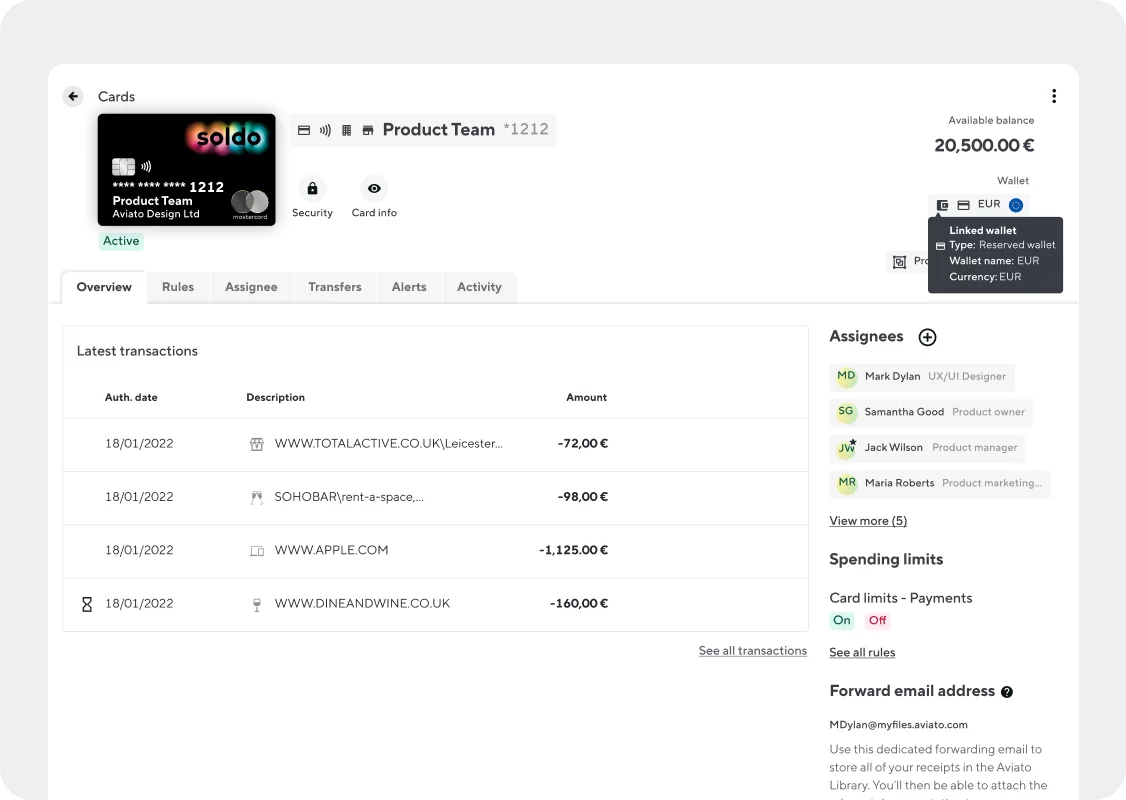

You can get a credit card for your business, but it will still need to be associated with the name of someone who works for the company. However, with prepaid cards like Soldo, you can assign cards to as many people as you need.

Can you get a credit card in a business name?

You can get a credit card for your business, but it will still need to be associated with the name of someone who works for the company. However, with prepaid cards like Soldo, you can assign cards to as many people as you need.

How can I get a business credit card without personal credit?

If you have poor personal credit then it can be tricky to get a business credit card. There are providers out there who will offer you one, but they may not have the benefits you were looking for. Alternatively, you could try out one of Soldo’s prepaid card plans, which have no credit score requirements.

How long does it take to get a business credit card?

There’s no precise amount of time it takes to get approved, and the process varies between providers, but you’re likely to get your decision within 5-10 days. After approval, it can take up to ten days for your card to arrive. For faster approvals, why not try Soldo, and you could be up and running the very next day.

How is business credit card limit determined?

Your credit limit will depend on your application, including your personal and business profile. Higher limits may be offered if you have better business or personal credit. You can read more on business credit limits here.

How can I get a higher business credit limit?

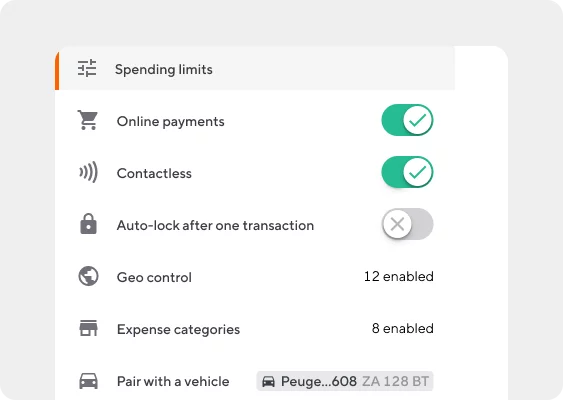

You can contact your card issuer to request a higher credit limit, but this may not be accepted, depending on your credit history. With Soldo, however, the only limits are those set by you.

Are there costs associated with credit cards for business?

Yes. Cards can come with a number of charges, including an annual rate, cash withdrawal fee, and interest. Although these vary depending on the provider, there’ll probably be at least one fee or another, so it’s worth researching before you commit to any one card issuer.

How to find the best company credit card for your business?

The ‘best’ credit card will depend on what your business needs. Each provider will offer charges and benefits that are more favourable to some businesses than others. They will also have differing eligibility criteria. Read our guide here for a comprehensive rundown of the best business credit cards.