Introducing mileage reimbursement

In speaking to our customers, we know two things to be true:

- Business mileage is one of the most common types of expense claims finance teams are managing day-to-day.

- Claiming and reimbursing business mileage is a challenge for both finance teams and employees.

That’s why we’re excited to introduce Soldo’s new mileage reimbursement feature, designed to make mileage claims and reimbursement easy and accurate for everyone involved. With this new feature, our customers can simplify business spending even further, managing every type of expense in one platform.

What business mileage reimbursement challenges are we looking to solve?

Here are some of the main challenges that have influenced our approach to mileage at Soldo:

- Employees who use their own personal vehicles, don’t get receipts for miles done for work, and must manually capture odometer readings etc. This makes reconciliation tricky, time-consuming, and frustrating.

- It goes without saying that finance teams need to reimburse mileage claims accurately. However, being fair and correct isn’t always easy with so many different types of vehicles and manual approaches to calculating distance.

- Many businesses use multiple disparate expense management processes and systems. This makes it impossible to centrally manage and stay on top of mileage – despite this being such a common business expense.

How does Soldo help with business mileage reimbursement?

Claim business mileage with ease

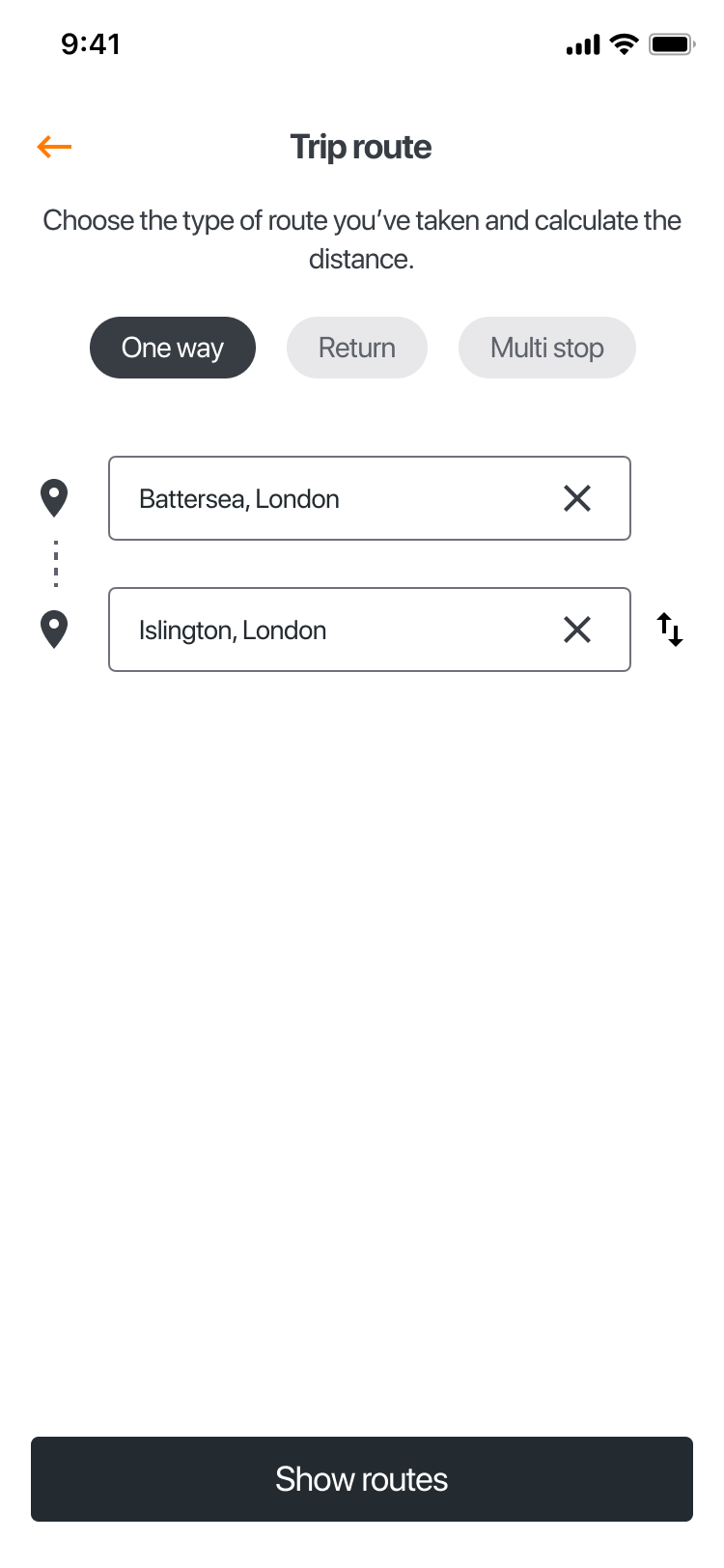

Using the Soldo Mobile App, employees can now add business trips and vehicle details in just a few taps. Soldo then automatically works out the reimbursement amount.

Here’s the best part: Soldo integrates seamlessly with Google Maps. Simply add your trip and vehicle details, then let Soldo calculate the distance for you. No more manual calculations.

Take control of mileage reimbursement rates

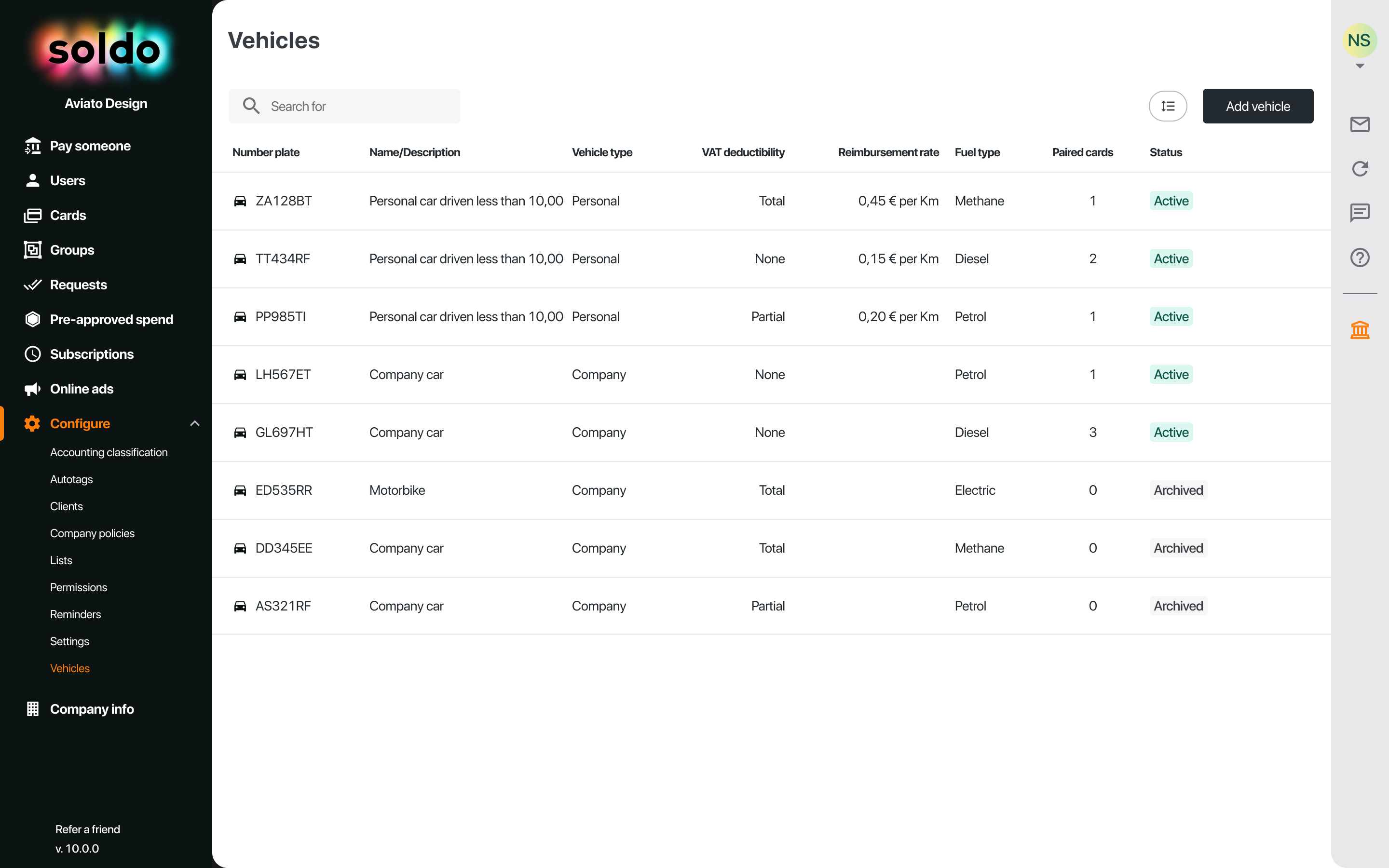

As an Admin, you can set default mileage reimbursement rates for various types of vehicles in Soldo – without being limited to a one-size-fits-all approach. Customise your rates by country, vehicle category, or even specific vehicle for advanced control and complete accuracy.

This level of customisation ensures that every mileage reimbursement is fair. An SUV isn’t the same as small-family hatchback, so why should they all be reimbursed at the same rate? With Soldo, you can configure the most common vehicle types and corresponding reimbursement rates.

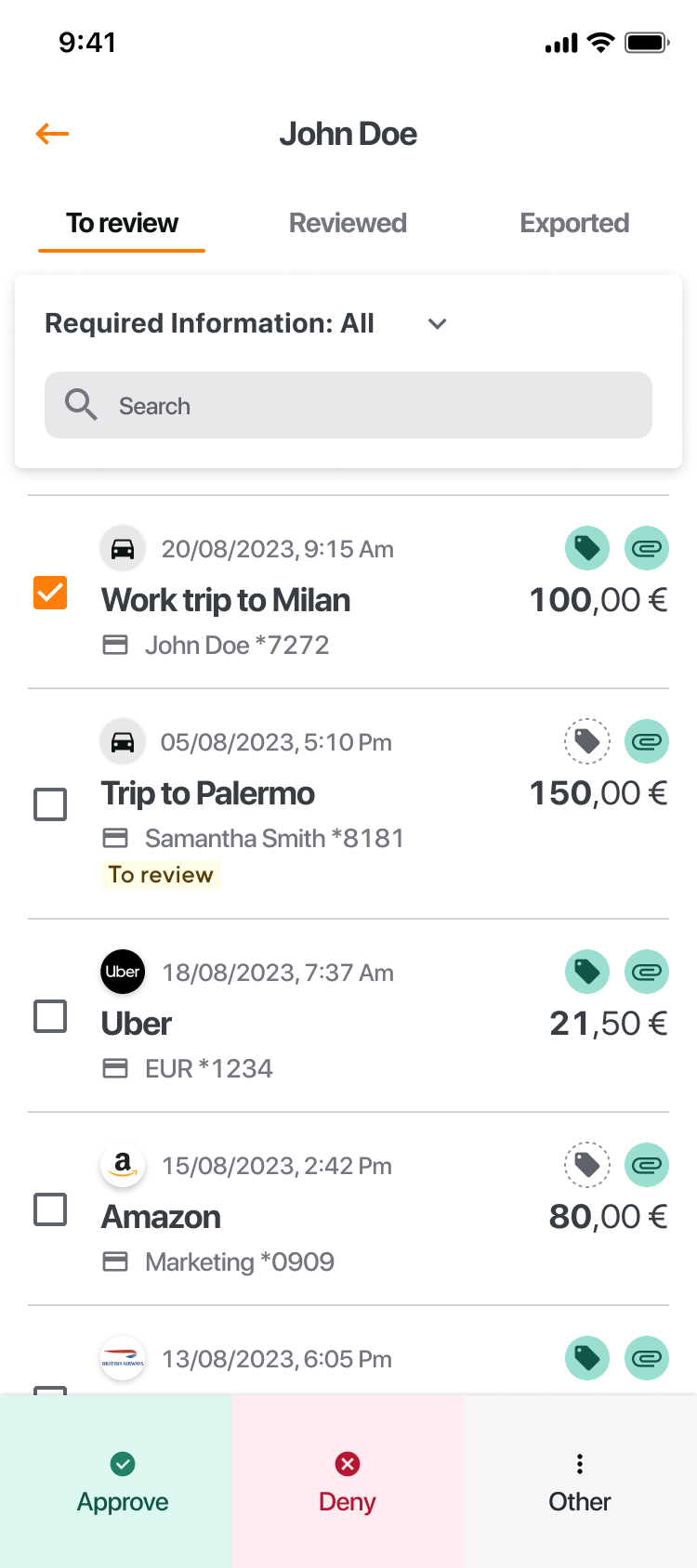

Works with Soldo’s expense review

Now, you can review and approve mileage reimbursement claims just like any other expense in Soldo. Managing every type of expense in one platform means you save time by streamlining and automating your processes.

No more jumping around between different systems or approaches to manage different types of expenses. Do it all in Soldo.

“I’m excited about the launch of our mileage reimbursement feature. This is a common business expense that our customers have asked to manage in Soldo, and from today they can. We’ve made it easy for employees to submit mileage claims and for finance teams to make sure that reimbursement is accurate and fair.” – Sarima Opara, Senior Product Manager, Soldo

Get started with mileage reimbursement today

The mileage reimbursement feature is available on our Premium and Enterprise plans. Get started today!

If you’re an Admin:

- Log in to the Soldo Web App.

- Add vehicles by clicking on ‘Configure’ in the left sidebar menu, then ‘Vehicles’.

- Fill in the vehicle details and set a mileage reimbursement for each vehicle category, or for specific vehicles.

If you’re an Employee or an Approver:

- Add your mileage in the ‘Users’ section of the Soldo Web App or Mobile App, just like you would for an out-of-pocket expense.

- Fill in the details, use our Google Maps integration to help you add the correct distance, and select the relevant vehicle to get the right reimbursement rate.

- Review and approve in minutes.

For more information, speak to your Account Manager or take a look at our FAQs.